Navigating Affordable Health Plans in the USA Made Easy

Why Affordable Health Plans Are Your Financial Safety Net

Affordable health plans are health insurance options designed to provide essential medical coverage without breaking your budget. With rising healthcare costs, finding the right plan can mean the difference between accessing care when you need it and facing overwhelming medical debt.

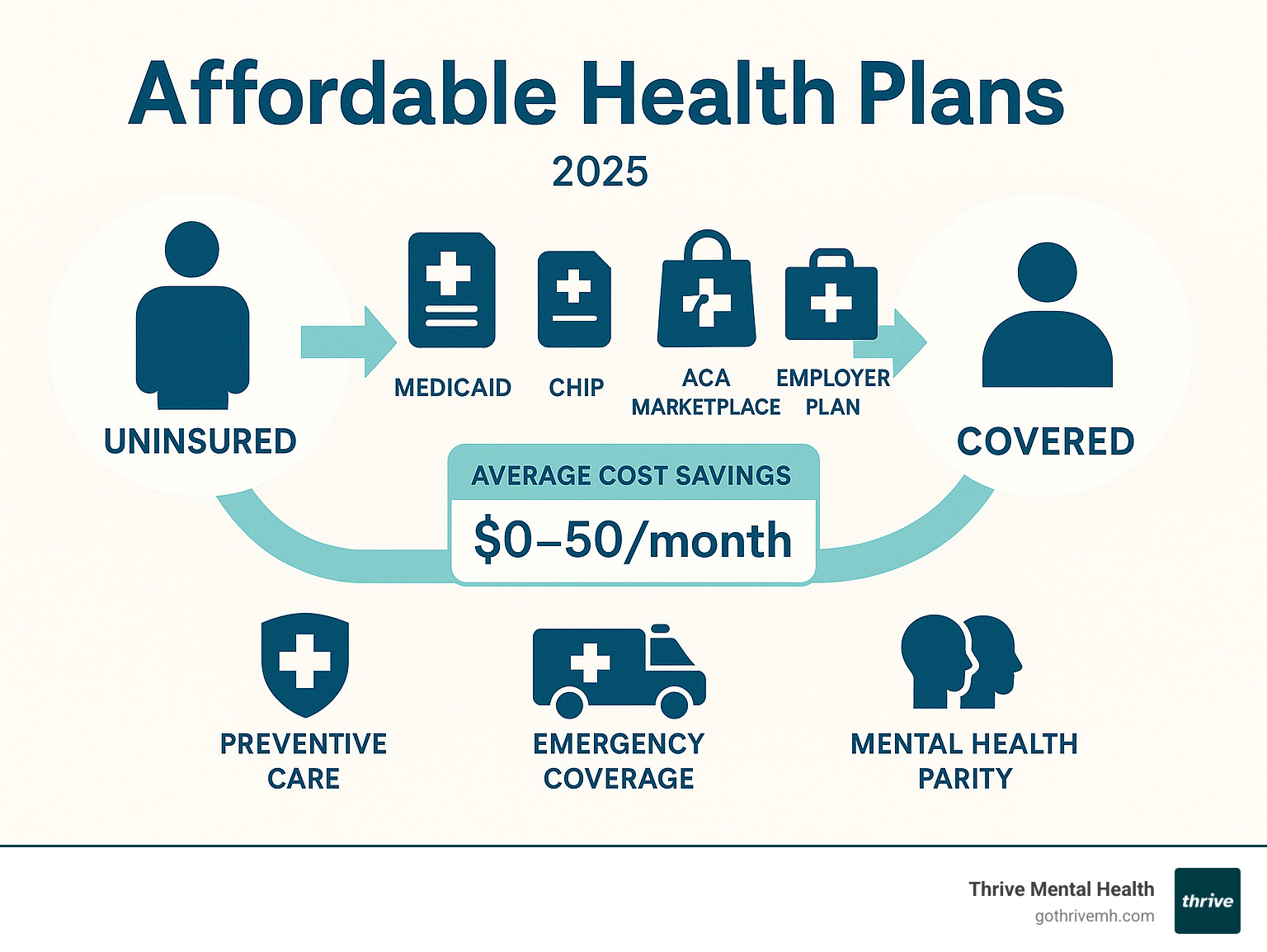

Quick Overview: Your Path to Affordable Coverage

- Government Programs: Medicaid, CHIP, and Medicare offer free or low-cost coverage for eligible individuals

- ACA Marketplace: Bronze, Silver, Gold, and Platinum plans with potential subsidies based on income

- Employer Plans: Often the most affordable option if available through your workplace

- Key Cost Factors: Your age, location, income, and household size determine your options and costs

The reality is stark: over half of Americans struggle with mental health, but many avoid care due to cost. Without coverage, a single ER visit can cost thousands, and therapy can run $400-800 monthly out-of-pocket.

The good news? Federal laws like the Affordable Care Act and Mental Health Parity Act ensure that mental health services are covered equally to physical health services. Programs like Medicaid can cost under $50 monthly or be completely free, while marketplace plans often provide subsidies that can reduce premiums to $0 for qualifying individuals.

Understanding your options isn’t just about saving money—it’s about accessing the care you need without the financial stress that can worsen anxiety and depression.

I’m Nate Raine, and through my work at Lifebit and as CEO of Thrive Mental Health, I’ve seen how navigating affordable health plans transforms access to mental healthcare. My experience in federal health partnerships and behavioral health shows that the right coverage strategy removes barriers to the support you deserve.

Understanding Health Insurance Costs and Affordability

Health insurance costs can feel overwhelming, but understanding them is your first step toward finding affordable health plans. Knowing what you’re looking at helps you make smart choices that protect both your health and your wallet.

Think of health insurance costs as a puzzle. Your monthly premium is just one piece; deductibles, copays, and other out-of-pocket expenses also determine what you’ll pay for healthcare.

The good news? These costs aren’t random. They’re based on specific factors about you and your situation, which means you can predict and plan for them. Plus, programs and subsidies are designed to make coverage more affordable for people at different income levels.

Key Terms You Must Know

Before we dive into the details, let’s decode the insurance language you’ll encounter. Don’t worry—it’s simpler than it sounds once you break it down.

Your premium is like your monthly membership fee. You pay this every month to keep your insurance active, whether you use healthcare services or not. It’s the most predictable part of your healthcare budget.

Your deductible is the amount you pay out of your own pocket before your insurance kicks in to help. If you have a $3,000 deductible, you’ll pay the first $3,000 of covered medical expenses yourself. After that, your insurance starts sharing the costs with you.

A copayment (copay) is a fixed fee you pay for specific services after you’ve met your deductible. You might pay $25 for a doctor visit or $50 for a therapy session. Many preventive services have $0 copays—meaning they’re completely free to you.

Coinsurance is when you and your insurance company split the bill by percentages. Your plan might cover 80% of a service while you pay the remaining 20%. This usually applies after you’ve met your deductible.

The out-of-pocket maximum is your financial safety net. Once you’ve spent this amount in a year on covered services, your insurance pays 100% of everything else. This protects you from truly catastrophic medical bills.

What Determines Your Health Insurance Cost?

Several factors influence what you’ll pay for health insurance, and understanding them helps you find the most affordable health plans for your situation.

Age plays a significant role—older adults typically pay higher premiums than younger people. This reflects the reality that healthcare needs often increase with age.

Your location matters more than you might think. Healthcare costs vary dramatically between states and even between zip codes within the same state. Rural areas might have fewer plan options, while urban areas often have more competition among insurers.

Household size directly affects your total premium since you’re paying to cover more people. However, family plans often offer better per-person rates than individual coverage.

Your income level is crucial for accessing affordable coverage. If you earn between 100% and 400% of the federal poverty level, you may qualify for premium tax credits that can dramatically reduce your monthly costs. Some people even qualify for plans with $0 monthly premiums after subsidies.

Tobacco use can increase your premiums in most states, sometimes by as much as 50%. The good news? Many insurers offer programs to help you quit and reduce these costs.

The plan category you choose makes a huge difference in your costs. Bronze plans have the lowest monthly premiums but higher deductibles and out-of-pocket costs. Silver plans offer a middle ground and are the only ones eligible for cost-sharing reductions if you qualify. Gold and Platinum plans have higher premiums but lower costs when you actually need care.

When you’re ready to see what your specific costs might look like, you can find out how to estimate your costs using official government tools. These calculators consider all these factors to give you a realistic picture of what you’ll pay.

Types of Affordable Health Plans Available

When it comes to finding affordable health plans, you have several pathways to explore. The best route depends on your specific situation and needs.

The main pathways to coverage include government marketplace plans, government-sponsored programs, and other coverage options like employer plans. Each has its own advantages, and understanding these differences will help you make the best choice for your health and budget.

ACA Health Insurance Marketplace Plans

The Affordable Care Act created the Health Insurance Marketplace, a one-stop shop for comparing and buying affordable health plans that fit your needs.

Marketplace plans come in metal tiers. Bronze plans have the lowest monthly cost, but you’ll pay more when you need care (they cover about 60% of costs). Silver plans offer a middle ground and are special because they’re the only ones that qualify for extra savings called cost-sharing reductions. Gold and Platinum plans have higher monthly costs but cover more when you actually use healthcare (80% and 90% respectively).

Financial assistance is a real game-changer. Based on your income and household size, you might qualify for premium tax credits that can dramatically lower your monthly payments. Some people even get plans for $0 per month. There are also catastrophic plans available for people under 30 or those who qualify for hardship exemptions.

Thanks to the ACA, you can’t be denied coverage for pre-existing conditions, and there are no lifetime limits on essential benefits. Young adults can stay on their parents’ plans until age 26, which is a huge relief for many families.

To fully understand your protections, learn about your rights under the ACA. If you’re specifically looking for mental health support, you might find our guide on exploring mental health resources with major insurers helpful.

Government-Sponsored Programs

Government programs often provide the most affordable health plans available—many are completely free or cost very little each month. These programs act as crucial safety nets for millions of Americans.

Medicaid is probably the most well-known program, offering free or very low-cost coverage to eligible individuals and families. Your eligibility depends mainly on your income and family size, though the exact requirements vary by state. Many states expanded their Medicaid programs under the ACA, so more people qualify than ever before. If you’re interested in mental health coverage specifically, we have detailed information about Medicaid covered therapy options.

The Children’s Health Insurance Program (CHIP) fills an important gap for families who earn too much for Medicaid but can’t afford private insurance. It provides low-cost health coverage for children and, in some states, pregnant women. The program often has minimal costs and comprehensive benefits.

Medicare serves people 65 and older, plus some younger individuals with disabilities or specific medical conditions. It has different parts covering hospital care, medical services, prescription drugs, and Medicare Advantage plans that combine everything into one package.

These programs ensure that cost doesn’t become a barrier to essential healthcare, including mental health services that are covered equally to physical health care.

Other Health Coverage Options

Beyond marketplace and government programs, several other avenues can lead to affordable health plans. Each serves different situations and needs.

Employer-sponsored insurance is often your best bet if it’s available. Most employers pay a significant portion of the premium, making these plans typically more affordable than individual coverage. The trade-off is less choice—you’re limited to whatever plans your employer offers.

Short-term health plans can bridge gaps in coverage, like between jobs. They have lower premiums but aren’t required to follow ACA rules, so they might not cover pre-existing conditions or essential benefits and can have coverage limits. They are designed for temporary situations, not long-term coverage.

Health Savings Accounts (HSAs) pair with high-deductible health plans to create a powerful savings tool. You contribute pre-tax money that can be used for qualified medical expenses, including therapy sessions. The triple tax advantage (deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses) makes HSAs incredibly valuable for managing healthcare costs. Learn more about Health Savings Accounts (HSAs) to see if this option makes sense for you.

COBRA lets you continue your employer’s health plan after you lose your job or experience certain qualifying events. While you keep the same benefits, you’ll typically pay the full premium plus an administrative fee. It’s expensive but provides continuity of care during transitions.

The key is matching your coverage type to your specific situation. Whether you need immediate coverage, have ongoing health needs, or are planning for the future, there’s likely an affordable option that fits your circumstances.

Eligibility and Enrollment for Affordable Health Plans

Getting the right affordable health plans is half the battle; knowing when and how to enroll is critical. Missing a deadline can mean waiting an entire year for another chance at coverage.

The good news is that once you understand the system, it’s much more straightforward than it first appears. Let’s walk through who qualifies for what and when you can actually sign up.

Who Is Eligible for affordable health plans?

Eligibility rules for affordable health plans are more inclusive than many people realize. The basic requirements for Marketplace plans, Medicaid, and CHIP are pretty consistent.

You need to live in the United States—that’s the fundamental residency requirement. Your primary residence must be in the U.S.

Citizenship and legal status play a role too. You must be a U.S. citizen, U.S. national, or lawfully present immigrant to qualify for most programs. If you’re unsure about your status or have questions about specific immigration situations, there’s helpful information for immigrants that breaks down the details.

Income matters, but not how you might think. There’s no income limit to use the Health Insurance Marketplace, but your income and household size determine if you qualify for financial help. For example, an individual earning under $30,000 or a family of four earning under $63,000 will likely qualify for significant subsidies, potentially lowering premiums to $0.

The best part? You can check your eligibility for a Marketplace plan online in just a few minutes. The tool will tell you exactly what programs you qualify for and estimate your costs.

Navigating Enrollment Periods

Timing is everything. Unlike other services, you can only sign up for health insurance during specific windows.

Open Enrollment is your main opportunity each year to get covered. For 2025 plans, this window typically runs from November 1st through January 15th in most states. During this time, anyone eligible can enroll in a new plan or switch their existing coverage. If you miss it, you generally must wait until next year unless you have a qualifying life event.

I always tell people to mark their calendars as soon as they know the dates. It’s that important.

Special Enrollment Periods are your safety net when life throws you a curveball. These Special Enrollment Periods give you a 60-day window to enroll in or change your health plan after certain qualifying events happen.

Losing other health coverage is probably the most common trigger. This could be losing your job, your COBRA running out, or turning 26 and aging off your parent’s plan. Household changes also qualify—getting married, divorced, having a baby, adopting a child, or experiencing a death in the family all open up enrollment opportunities.

Moving can trigger a Special Enrollment Period too, especially if you’re relocating to a new state or county where different plans are available. Even income changes that affect your subsidy eligibility can qualify you for a special enrollment opportunity.

The key is acting quickly. These periods usually last just 60 days from when the qualifying event happens, so you can’t wait around to make a decision.

Understanding these key dates and deadlines isn’t just about following rules—it’s about ensuring you and your family have access to the mental health care and medical services you need when you need them most.

Finding, Comparing, and Utilizing Your Plan

Once you understand the types of plans and eligibility, the next step is finding the right one and then making the most of its benefits.

How to Find and Compare Plans in Your Area

Finding the right affordable health plans doesn’t have to be overwhelming. Like any important purchase, you should compare your options before making a decision.

The official Health Insurance Marketplace® is your best starting point. This government website lets you see all available plans in your area and compare them side-by-side. Healthcare.gov will redirect you if your state runs its own marketplace.

Before you even start a full application, you can get a sneak peek at what’s available. The preview plans and prices tool only needs your ZIP code and basic information about your estimated income and household size. This gives you a realistic idea of potential costs and available subsidies without any commitment.

If the process feels daunting, you don’t have to go it alone. Navigators are trained professionals who provide free, unbiased help with applications. Licensed insurance brokers can also guide you, often at no cost to you.

Understanding Your Coverage and Benefits

Once enrolled, understanding what your plan actually covers is where the real value lies.

Every plan sold through the Health Insurance Marketplace must cover essential health benefits. This includes outpatient care, emergency services, hospitalization, prescription drugs, mental health and substance use disorder services, rehabilitative services, and preventive care. You can explore the full details of what Marketplace plans cover.

One of the most valuable benefits of ACA-compliant plans is preventive care coverage. This means vaccinations, screenings, and certain health counseling come at no extra cost to you—no copay, coinsurance, or deductible. It’s like getting a head start on staying healthy without worrying about the bill.

Prescription drug coverage is included in most plans, though the specifics vary widely. If you take regular medications, always check your plan’s formulary—that’s the official list of covered drugs. Understanding which tier your medications fall into can save you hundreds of dollars annually.

Understanding your plan can feel complex, especially when comparing different providers. For those seeking mental health support, knowing the differences in coverage between insurance providers becomes crucial for accessing the care you need. Resources like understanding insurance coverage for dialectical behavior therapy can help you make informed decisions about your mental health benefits.

The Importance of Mental Health Coverage in affordable health plans

Mental health coverage is a fundamental part of comprehensive healthcare, impacting your well-being and financial security.

The Mental Health Parity and Addiction Equity Act changed the game for mental health coverage. This federal law requires that mental health and substance use disorder benefits can’t be more restrictive than medical benefits. Simply put, your plan must cover mental health services equally, with the same deductibles, copays, and out-of-pocket maximums.

Most affordable health plans, especially those through the ACA Marketplace or employer-sponsored plans, include robust coverage for therapy and counseling. This includes both in-person sessions and increasingly popular online therapy options. Research consistently shows the effectiveness of internet-based cognitive behavioral therapy (CBT) for treating various mental health conditions.

Online therapy has emerged as a particularly affordable option within many insurance plans. The full cost of an online therapy session can sometimes equal what you’d pay as a copay for traditional in-person therapy. Many covered members pay an average copay of less than $30 for therapy sessions, making consistent mental health support much more accessible.

For those with more significant mental health needs, understanding how your plan covers Intensive Outpatient Programs (IOP) and Partial Hospitalization Programs (PHP) becomes crucial. These structured programs provide a higher level of care than traditional outpatient therapy, offering comprehensive support while allowing you to maintain your daily routine.

At Thrive Mental Health, we specialize in both virtual and in-person IOP and PHP programs designed for adults and young professionals. Our flexible, expert-led, evidence-based care is custom to individual needs and accessible from anywhere. Understanding your Virtual IOP Insurance benefits is an important step toward accessing the comprehensive support you deserve.

Frequently Asked Questions about Affordable Health Plans

Let’s tackle some of the most common questions we hear from people trying to steer health insurance. These are real concerns that come up time and time again.

Can I get health insurance if I have a pre-existing condition?

Yes, absolutely. This is one of the most important protections the Affordable Care Act brought us. If you have diabetes, depression, cancer, or any other health condition, insurance companies cannot turn you away or charge you more because of your medical history.

This was a game-changer for millions. Before the ACA, a pre-existing condition could mean being denied coverage or facing unaffordable premiums.

Now, all affordable health plans that comply with the ACA must cover essential health benefits without annual or lifetime limits. This means your coverage can’t be capped at a certain dollar amount, no matter how much care you need.

What if my employer’s plan is not affordable?

This hits home for many families. Just because your employer offers health insurance doesn’t mean it fits your budget. The good news is that you might still qualify for help through the Health Insurance Marketplace.

The government has specific rules about what makes employer coverage “affordable.” If your employer’s plan costs more than a certain percentage of your household income, or if it doesn’t provide minimum value, you may be eligible for premium tax credits and cost-sharing reductions on a Marketplace plan.

The “family glitch” was a frustrating problem where an employee’s plan was affordable for them but not for their family, who couldn’t get Marketplace subsidies. Recent changes have largely fixed this, opening up more options for families.

If your employer plan feels out of reach financially, it’s always worth checking your eligibility on Healthcare.gov. You might be surprised by what’s available.

Are there plans with $0 monthly premiums?

Yes, many people can get health coverage with no monthly premium. This is how the system is designed to work for those who need it most.

Premium tax credits through the Health Insurance Marketplace can cover your entire monthly premium if your income falls within certain ranges. Many people with lower incomes find that these subsidies completely cover the cost of a Bronze or Silver plan, leaving them with a $0 monthly bill.

Medicaid is often completely free for those who qualify. No monthly premiums, and often no deductibles or copays either. This program has been a lifeline for millions of Americans who need healthcare but can’t afford traditional insurance.

Even some Marketplace plans can become $0 after subsidies are applied. The amount of financial help you receive depends on your income and household size, but the savings can be substantial.

Even with a $0 premium plan, you may have out-of-pocket costs for care (unless you’re on Medicaid). Eliminating the premium, however, can make a huge difference in your budget and peace of mind.

Conclusion

Finding the right affordable health plans doesn’t have to be a puzzle. This guide walked you through the essential steps, from understanding insurance terms to finding programs that can save you money.

The most important thing to remember is that knowledge is power in healthcare. Understanding premiums, deductibles, and out-of-pocket maximums helps you choose a plan that fits your budget. Knowing about enrollment periods and qualifying life events ensures you won’t miss crucial deadlines.

Your health and financial security are worth protecting. Whether through free Medicaid, a subsidized $0 premium marketplace plan, or an employer plan, genuine options exist to make healthcare accessible.

The path forward is clearer than it might have seemed at the start. Government programs like Medicaid and CHIP provide safety nets for millions of families. The ACA Marketplace offers subsidies that can dramatically reduce costs. Even if you’re facing challenges with employer coverage or have pre-existing conditions, federal protections ensure you can’t be left behind.

Mental health coverage deserves special attention in your planning. The Mental Health Parity Act means your plan must treat mental health services equally to physical health services. For those seeking comprehensive mental health support, understanding how your plan covers services like Intensive Outpatient Programs (IOP) and Partial Hospitalization Programs (PHP) is the next step toward getting the care you deserve.

At Thrive Mental Health, we’re here to help you steer your benefits for flexible, expert-led care custom to your individual needs. We believe that everyone deserves access to quality mental healthcare, and understanding your insurance is a powerful tool in achieving that goal.

Ready to take the next step? Learn more about navigating your specific insurance plan for mental health care and find how we can support your journey to wellness.