Insurance Policies Explained: No Jargon, Just Clarity

What is an Insurance Policy and Why Does It Matter?

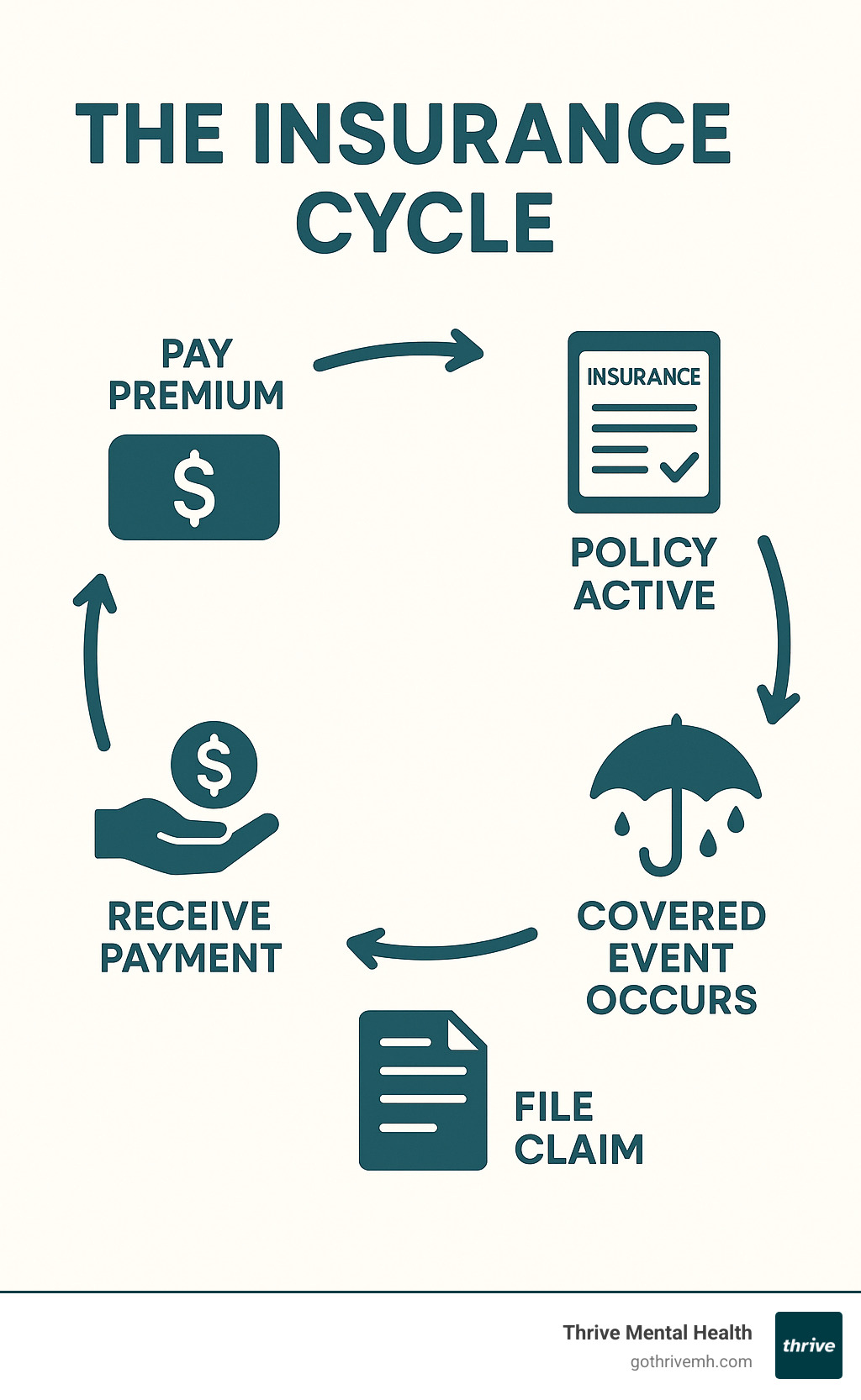

An insurance policy is a legal contract between you and an insurance company where you pay a premium in exchange for financial protection against specific risks. (If you want a quick primer on the broader concept of insurance, check out this overview on Wikipedia.) Understanding this contract can save you thousands of dollars and prevent major headaches when you need coverage most.

Here’s what every insurance policy includes:

- Declarations Page – Who’s covered, what’s covered, and how much you’ll pay

- Insuring Agreement – What the insurance company promises to do

- Exclusions – What’s NOT covered (this is crucial to know)

- Conditions – Your responsibilities as the policyholder

- Definitions – What specific terms mean in your contract

Why does this matter? Most people buy insurance without reading the fine print. Then when disaster strikes, they find their policy doesn’t cover what they thought it did. A homeowner might find out flood damage isn’t covered. A driver might learn their policy won’t pay for a rental car. Someone seeking mental health treatment might find their intensive outpatient program isn’t included in their benefits.

The stakes are especially high in Florida, where hurricanes, floods, and other natural disasters make insurance coverage critical for financial survival. Whether you’re protecting your home, your health, or your family’s future, knowing exactly what your insurance policy covers – and what it doesn’t – is essential.

I’m Nate Raine, CEO of Thrive Mental Health, and through my work helping clients steer their insurance policy benefits for behavioral health services, I’ve seen how confusing these contracts can be. My experience in healthcare strategy has taught me that understanding your insurance policy upfront prevents costly surprises later when you need care most.

Decoding the Document: The Essential Parts of an Insurance Policy

Think of your insurance policy as a recipe – except instead of making cookies, you’re creating financial protection. And just like you wouldn’t want to find halfway through baking that you’re missing a key ingredient, you don’t want to find out during a crisis that you misunderstood your coverage.

Every insurance policy follows the same basic structure, like chapters in a book. Each section has a specific job, and together they create the complete picture of your protection. Let’s break down these essential components so you can read your policy like a pro.

The Declarations Page

The Declarations Page is your insurance policy’s highlight reel – all the most important details packed into one or two pages. This is where you’ll find the personalized information that makes your policy uniquely yours.

Who is insured appears right at the top, listing your name and anyone else covered under the policy. What is covered follows next – for car insurance, this means your vehicle’s make, model, and VIN number. For health insurance, it might list specific family members.

Your policy limits tell you the maximum amount your insurer will pay for covered losses. Think of this as your insurance company’s spending limit on your behalf. The policy period shows exactly when your coverage starts and ends – crucial information since gaps in coverage can leave you vulnerable.

You’ll also see your premium amount (what you pay) and your deductibles (what you pay before insurance kicks in). These numbers work together to determine your out-of-pocket costs when you need care.

The Insuring Agreement

This section contains the insurance company’s main promises to you. It’s where they spell out exactly what they’ll do when you need them most. The Insuring Agreement typically covers three key areas: paying for covered losses, providing specific services, and defending you in lawsuits when applicable.

For example, your homeowner’s insurance policy might promise to “pay for direct physical loss or damage to your property caused by covered perils.” Health insurance policies promise to pay for covered medical services when you meet certain conditions.

Understanding these promises helps you know what to expect when you file a claim. It’s your insurance company putting their commitments in writing.

Exclusions

Here’s where things get real – the exclusions section tells you what your insurance policy won’t cover. While it might feel negative, this section is actually your friend because it prevents unpleasant surprises later.

Excluded perils are specific events your policy doesn’t cover. Most homeowner’s policies exclude floods and earthquakes, which is why you need separate coverage for these risks. Excluded losses refer to types of damage that aren’t covered, like normal wear and tear on your car. Excluded property lists items that fall outside your coverage, such as business equipment in your home office.

In Florida, understanding exclusions is especially important. Many homeowners find too late that their standard policy excludes hurricane damage or flooding – two very real risks in our state.

For mental health coverage, exclusions might include certain types of treatment or specific conditions. That’s why we always encourage clients to review this section carefully before starting treatment programs.

Conditions

The conditions section outlines your responsibilities as the policyholder. Think of these as the rules you need to follow to keep your coverage valid. Break these rules, and your insurer might deny your claim.

Policyholder duties include basics like notifying your insurance company promptly after an incident. Rules of conduct might require you to protect your property from further damage after a loss. The proof of loss condition means you’ll need to provide documentation supporting your claim.

The cooperation clause requires you to work with your insurer during claim investigations, while claim procedures spell out the exact steps for filing a claim. These might seem like bureaucratic problems, but they’re designed to prevent fraud and ensure legitimate claims get paid quickly.

Understanding these conditions before you need them makes the claims process much smoother. It’s like knowing the emergency exits before the plane takes off – hopefully you’ll never need them, but you’ll be glad you paid attention if you do.

The Fine Print: How Policies Define Coverage and Legal Terms

Reading an insurance policy can feel like decoding a foreign language, but understanding the legal framework behind these documents will help you make sense of what you’re actually buying. These aren’t your typical contracts – they operate under special legal rules that can work in your favor if you know what to look for.

Unique Legal Characteristics

Think of your insurance policy as a very special type of contract with some quirky legal traits that make it different from, say, buying a car or signing a lease.

First, it’s what lawyers call a Contract of Adhesion. This fancy term simply means the insurance company wrote all the rules, and you either take it or leave it – there’s no negotiating. You can’t cross out sections you don’t like or add your own terms. But here’s the silver lining: because you had no say in the wording, courts often interpret confusing language in your favor, not the insurance company’s. This is called the “doctrine of reasonable expectations,” and it’s your friend when policy language gets murky.

Your insurance policy is also an Aleatory Contract, which sounds complicated but isn’t. It just means the exchange isn’t equal – you might pay $1,200 in premiums this year, but if your house burns down, the insurance company might pay out $300,000. Or you might pay for years and never file a claim. It’s based on chance, like a very serious lottery you hope you never win.

The principle of Utmost Good Faith means both you and your insurer need to be completely honest with each other. You can’t hide that you’re a smoker when applying for life insurance, and they can’t hide important policy details from you. It’s a two-way street of honesty.

Finally, your insurance policy is a Unilateral Contract – only the insurance company makes promises. You’re not legally required to pay your premiums, but if you don’t, they’re off the hook for covering you. Simple as that.

Named-Perils vs. All-Risk Coverage

When it comes to what’s actually covered, insurance policies work in two very different ways, and understanding the difference can save you from nasty surprises.

Named-Perils Coverage is like having a very specific shopping list. Your policy will literally list every single thing that’s covered – fire, theft, windstorm, hail – and if your problem isn’t on that list, you’re out of luck. If a tree falls on your car during a windstorm, you’re covered. If that same tree falls during a calm day because it was diseased, you might not be, depending on how the policy is written.

All-Risk Coverage (sometimes called “open perils”) flips this around completely. Instead of listing what’s covered, it covers everything except what’s specifically excluded. This gives you much broader protection, but you still need to read those exclusions carefully.

| Feature | Named-Perils Coverage | All-Risk Coverage |

|---|---|---|

| What’s Covered | Only specific perils listed in your policy | Everything except what’s specifically excluded |

| Burden of Proof | You must prove a covered peril caused your loss | Insurer must prove an exclusion applies to deny your claim |

| Scope | More limited protection | Broader, more comprehensive coverage |

| Common Examples | Basic auto policies, some older property policies | Most modern homeowners policies, comprehensive auto coverage |

Most modern policies use the all-risk approach because it’s more comprehensive. But don’t let the name fool you – “all-risk” doesn’t mean every risk. Those exclusions sections are still crucial to understand.

Here in Florida, this distinction becomes especially important. Your all-risk homeowners policy might cover wind damage from a hurricane, but flood damage from that same storm could be excluded, requiring separate flood insurance. Understanding whether your coverage is named-perils or all-risk helps you know what questions to ask and what additional coverage you might need.

For those dealing with mental health coverage, these principles apply too. Your health insurance policy might cover mental health services broadly, but have specific exclusions or limitations for certain types of intensive programs. That’s why we always recommend calling your insurer to verify coverage for specialized care like intensive outpatient programs before starting treatment.

Navigating Your Options: Common Types of Insurance Policies

The world of insurance policies can feel overwhelming at first glance. But here’s the thing – most policies fall into just a few main categories that protect different aspects of your life. Whether you’re safeguarding your car, your home, your health, or your family’s future, understanding these categories helps you make smarter decisions about your coverage.

Think of insurance policies as falling into three main buckets: Property and Casualty Insurance protects your stuff and covers you if you accidentally harm someone else. Life and Disability Insurance ensures your family stays financially secure if something happens to you. And Health Insurance takes care of medical expenses, including the mental health services that are so important for overall wellbeing.

Property and Casualty Insurance

These policies are your financial shield against damage to your belongings and liability when accidents happen. If you live in Florida like many of our clients, you know how crucial these protections can be.

Auto insurance is legally required in Florida, and for good reason. Your insurance policy covers damage to your vehicle, medical expenses if you or others get hurt, and protects you financially if you cause an accident. The key is finding the right balance of coverage and cost that fits your situation.

Homeowners insurance protects what’s likely your biggest investment – your home. But here’s where Florida residents need to pay extra attention. Standard homeowners policies often exclude flood damage, which means you might need a separate flood insurance policy. Given our state’s hurricane season and flooding risks, understanding exactly what your policy covers could save you from financial disaster.

Renters insurance is often overlooked, but it’s incredibly valuable. Even though your landlord has insurance on the building, that doesn’t protect your personal belongings or cover you if someone gets hurt in your apartment. A renters insurance policy fills those gaps at a surprisingly affordable cost.

Life and Disability Insurance

These policies protect your most valuable asset – your ability to earn income and provide for your family.

Term life insurance gives you coverage for a set period, like 10 or 20 years. If something happens to you during that time, your loved ones receive a death benefit. It’s straightforward and typically more affordable than permanent coverage, making it perfect for young families or anyone with temporary financial obligations.

Whole life insurance offers lifelong protection with a twist – it builds cash value over time that you can borrow against. While more expensive than term life, it combines insurance with a savings component that some people find appealing.

Disability insurance often gets forgotten, but it’s incredibly important. Short-term disability replaces part of your income for a few months if illness or injury keeps you from working. Long-term disability provides income protection for years, potentially until retirement, if you face a serious, lasting disability.

The reality is that you’re more likely to become disabled than to die during your working years, yet most people have life insurance but skip disability coverage. It’s worth considering both as part of your financial protection plan.

Health Insurance: Understanding Your Mental Health Insurance Policy

Health insurance policies have come a long way, especially when it comes to mental health coverage. This is particularly important to us at Thrive Mental Health, where we help people steer their benefits for intensive outpatient and partial hospitalization programs.

Major medical plans – whether they’re HMOs, PPOs, or other types – must include mental health coverage thanks to the Affordable Care Act. This means your insurance policy should cover therapy, counseling, and more intensive treatments like the IOP and PHP programs we offer.

The Mental Health Parity Act takes this protection even further. It ensures that your mental health benefits can’t be more restrictive than your medical benefits. So if your insurance policy covers doctor visits with a $20 copay, your therapy sessions should have similar cost-sharing requirements.

Verifying benefits for IOP and PHP programs is where things can get tricky, but it’s crucial if you’re considering intensive mental health treatment. Major insurers like UnitedHealthcare, Cigna, Blue Cross Blue Shield, and Aetna typically provide coverage for these programs, but the details matter. Your deductible, copays, and out-of-pocket maximums all affect what you’ll actually pay.

Many of our Florida clients are surprised to learn that their out-of-pocket costs for mental health treatment can be quite reasonable – sometimes even $0 depending on their specific insurance policy. We help our clients understand these benefits because navigating insurance shouldn’t add stress when you’re already dealing with mental health challenges.

Telehealth coverage has also expanded dramatically, with most major insurers now including online therapy as a standard behavioral health benefit. This flexibility has been a game-changer for busy professionals who need quality mental health care that fits their schedule.

For our Florida clients specifically, understanding how local insurance plans work with mental health services is essential. We’ve seen how Florida Blue is revolutionizing health insurance in our state, and we have extensive experience navigating mental health support with major insurers to help our clients get the care they need.

Frequently Asked Questions about Your Insurance Policy

Let’s be honest – insurance policies can feel like they’re written in a foreign language. Even after reading through all the components and legal terms, you probably still have some burning questions. Don’t worry, you’re not alone. Here are the questions I hear most often from clients at Thrive Mental Health, along with straightforward answers that actually make sense.

What is the difference between a premium and a deductible?

Think of these as two completely different parts of your insurance policy costs, and understanding them can save you from some unpleasant surprises.

Your premium is basically your membership fee. It’s what you pay regularly (monthly, quarterly, or annually) just to keep your insurance policy active, whether you use it or not. If your car insurance premium is $150 per month, you’re paying that $150 every single month to maintain your coverage. Stop paying, and your coverage stops too.

Your deductible, on the other hand, only comes into play when something actually happens. It’s the amount you have to pay out of your own pocket before your insurance kicks in to help. Let’s say you have a $500 deductible on your health insurance policy and need a procedure that costs $2,000. You’ll pay the first $500, and your insurer covers the remaining $1,500 (assuming it’s a covered service).

Here’s where it gets interesting: these two numbers often work in opposite directions. Choose a higher deductible, and you’ll usually pay lower premiums. Pick a lower deductible, and expect higher monthly premiums. It’s all about finding the balance that works for your budget and comfort level.

How do I get a copy of my insurance policy?

You’d be surprised how many people have never actually seen their full insurance policy document. They have their insurance card, maybe a declarations page, but not the complete contract that spells out exactly what’s covered.

Your insurance agent is usually your best starting point. They can walk you through getting a copy and might even explain the confusing parts. Most insurance companies also have online portals where you can log in and download your documents instantly – no waiting, no phone calls.

If you’re more of a digital person, check your email. Many insurers send policy documents electronically these days. And if you’re old-school and want paper in your hands, just call your insurance company directly. Have your policy number ready, and they’ll mail you a complete copy.

Pro tip: Don’t just file it away once you get it. Actually read through it, especially the exclusions section. That’s where you’ll find what’s not covered, which is often more important than what is.

How can I check if my Florida health insurance covers mental health services like IOP?

This question hits close to home for us at Thrive Mental Health, and honestly, it’s one of the most important questions you can ask about your insurance policy.

The most reliable way to get accurate information is to call the member services number on the back of your insurance card. When you call, don’t just ask if mental health is covered – be specific. Ask about Intensive Outpatient Programs (IOP) and Partial Hospitalization Programs (PHP). Find out your deductible, copay amounts, and whether you need a referral or pre-authorization.

Your Summary of Benefits and Coverage (SBC) is another goldmine of information. Every health plan must provide this standardized document, and it breaks down your benefits in plain English. You can usually find it on your insurer’s website or request a copy.

Here’s something crucial: make sure any provider you’re considering is in your network. At Thrive Mental Health, we help our Florida clients steer this verification process because using an out-of-network provider can dramatically increase your costs.

Don’t forget about telehealth coverage either. Many insurance policies now cover virtual mental health services, which can be a game-changer for accessing care. You can learn more about this in our guide on Virtual IOP Insurance.

While federal laws require mental health coverage, the specifics of your plan – like how much you’ll pay out of pocket – vary significantly. Insurance claims can take 60+ days to process, so understanding your financial responsibility upfront helps you plan better and focus on what really matters: getting the care you need.

Conclusion: Empower Yourself by Understanding Your Coverage

You’ve made it through the maze of insurance policy components, legal jargon, and coverage types – and that’s no small feat! But here’s the thing: this knowledge isn’t just academic. It’s your financial armor in a world full of unexpected challenges.

Think about it this way: your insurance policy is like a safety net, but only if you know where the holes are. We’ve walked through everything from your Declarations Page (your policy’s executive summary) to those sneaky Exclusions that can trip you up when you least expect it. We’ve decoded the legal characteristics that make insurance contracts unique and explored the difference between named-perils and all-risk coverage.

Most importantly, we’ve highlighted how crucial it is to understand your mental health benefits. Whether you’re dealing with anxiety, depression, or other mental health challenges, knowing exactly what your insurance policy covers for services like IOP and PHP can be the difference between getting the care you need and facing overwhelming out-of-pocket costs.

Here’s what empowerment looks like in practice: You call your insurance company and ask specific questions about your mental health benefits. You understand your deductible versus your premium. You know whether you need a referral for specialized care. You’ve read the fine print before you need to use your coverage.

At Thrive Mental Health, we see how confusing insurance can be for our clients across Florida. That’s why we don’t just provide expert-led, evidence-based mental health care – we help you steer your benefits too. We believe that understanding your insurance policy is part of taking control of your mental wellness journey.

Your next step is simple but powerful: Don’t wait for a crisis to read your insurance policy. Set aside an hour this week to review your coverage. Call your insurer with questions. Make sure you understand what’s covered and what isn’t, especially for mental health services.

For our Florida clients who want deeper insights into how their specific plans work with mental health care, we’ve created detailed resources to help. View our comprehensive guide to Aetna, Florida Blue, and Evernorth plans to see exactly how your coverage can support your mental health journey.

Remember: knowledge is power, and understanding your insurance policy gives you the power to protect what matters most – your health, your family, and your financial future.