Insuring Your Mind: Understanding Florida Mental Health Benefits

Why Understanding Mental Health Insurance Florida Matters Right Now

Navigating mental health insurance Florida can feel impossible, but understanding your rights is the key to open uping affordable, high-quality care. Knowing your coverage can save you thousands and get you the help you need, faster.

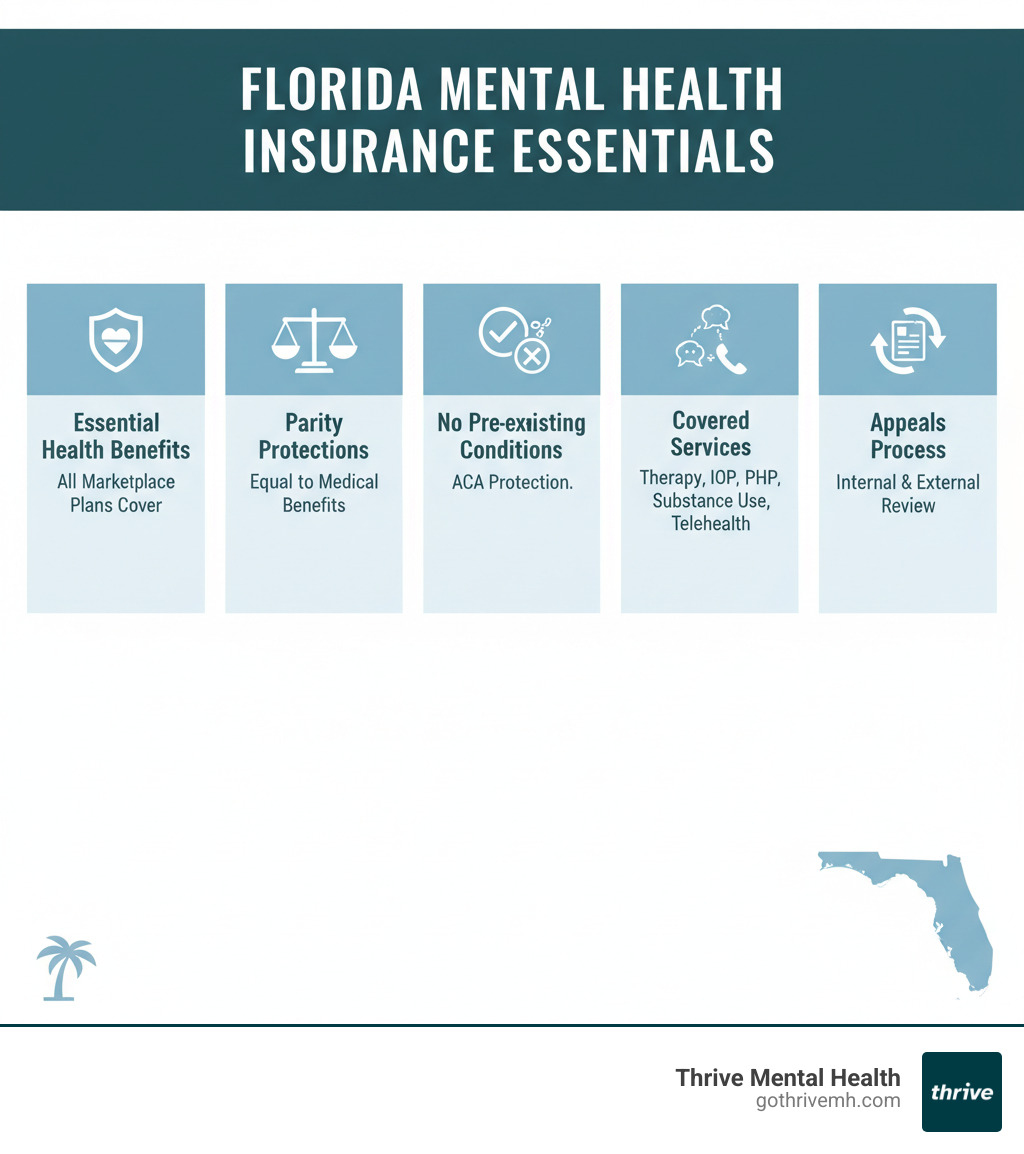

Here are the essentials:

- ACA Mandate: All Florida Marketplace plans must cover mental health services.

- No Pre-Existing Condition Denials: Insurers cannot deny you or charge you more for past mental health issues.

- Parity Protections: Your mental health benefits must be equal to your medical benefits (e.g., same copays and visit limits).

- Right to Appeal: You have the legal right to fight insurance denials.

At Thrive Mental Health, we help Floridians steer their insurance daily to access IOP and PHP programs. This guide will give you the tools to do the same.

Important mental health insurance Florida terms:

Your Rights: What Florida & Federal Law Guarantees for Mental Health Coverage

Here’s the truth: mental health insurance Florida plans are legally required to cover your care—and they can’t treat your mental health any differently than they treat a broken bone. Understanding these protections is empowering and ensures you get what you’re entitled to.

The Affordable Care Act (ACA) established mental health and substance use disorder services as “essential health benefits.” This means every plan on Florida’s Health Insurance Marketplace must cover therapy, counseling, and inpatient care without yearly or lifetime caps. For more on this, see our guide on the benefits of insurance for mental health.

Taking it a step further, the federal Mental Health Parity and Addiction Equity Act (MHPAEA) ensures that if a plan covers mental health, those benefits can’t be more restrictive than medical benefits. This applies to most employer, Medicaid, and private plans. It’s a fairness rule: your copays, deductibles, and treatment limits for mental health must match those for physical health. The federal guidance on parity laws provides official details.

Florida also has state-level protections. Florida Statute 627.668 requires insurers to make mental health coverage available to group health plans, ensuring many employers can offer these benefits.

Can an insurer deny me for my depression or anxiety?

No. The ACA made it illegal for any Marketplace plan in Florida to deny you coverage, charge higher premiums, or refuse to pay for essential benefits due to a pre-existing condition like depression, anxiety, or addiction. This protection is absolute, and your coverage starts on day one without waiting periods.

Are my mental health benefits equal to my medical benefits?

Yes, it’s the law. The Mental Health Parity and Addiction Equity Act (MHPAEA) mandates that your mental health insurance Florida benefits match your medical benefits.

This means:

- Financials: Your copays, coinsurance, and deductibles must be the same for mental health as they are for medical care.

- Treatment Limits: Your plan can’t impose stricter visit limits for therapy than it does for physical therapy.

- Care Management: Rules for prior authorization and proving medical necessity cannot be more restrictive for mental health services.

If your plan requires you to jump through more hoops to see a therapist than a cardiologist, that’s a potential parity violation. At Thrive Mental Health, we help Floridians navigate these parity laws to ensure they get the full benefits they’re entitled to for our IOP and PHP programs.

Decoding Your Plan: What’s Covered and How Much You’ll Actually Pay

Insurance documents are confusing, but understanding your mental health insurance Florida plan is crucial to avoiding surprise bills. Your Summary of Benefits and Coverage (SBC) is your roadmap. This document, which insurers must provide, details your costs. If you can’t find it, call the member services number on your card. Our guide on how to understand your benefits plan can also help.

Here’s a breakdown of key cost terms:

- Deductible: The amount you pay before insurance starts paying.

- Copay: A flat fee you pay per session after meeting your deductible.

- Coinsurance: A percentage of the cost you pay after meeting your deductible.

- Out-of-Pocket Maximum: The most you’ll pay in a year. After you hit this, insurance covers 100% of in-network costs.

| Cost Type | In-Network (Example) | Out-of-Network (Example) | What It Means for You |

|---|---|---|---|

| Deductible | $1,000 – $5,000 | $2,000 – $10,000+ | What you pay out of pocket before insurance starts covering costs. |

| Copay | $15 – $50 per visit | Varies, often higher | Fixed amount per therapy session after you’ve met your deductible. |

| Coinsurance | 10% – 30% | 40% – 70%+ | Your share of the cost (as a percentage) after meeting your deductible. |

| Out-of-Pocket Max | $3,000 – $8,000+ | $6,000 – $15,000+ | The absolute most you’ll pay in a year—after this, insurance covers 100%. |

Watch out for prior authorization, which means your insurer must approve a service beforehand. Intensive treatments like Intensive Outpatient Programs (IOP) and Partial Hospitalization Programs (PHP) often require it. At Thrive Mental Health, we handle this for you.

What specific services are covered?

Most Marketplace and employer plans in Florida cover a wide range of services due to the ACA’s essential health benefits rule. This includes:

- Individual, group, and family therapy

- Inpatient mental health services

- Substance use disorder treatment

- Psychiatric care and medication management

- Intensive Outpatient Programs (IOP): Structured therapy for 9-12 hours per week.

- Partial Hospitalization Programs (PHP): More intensive care, often 5-7 days a week for several hours a day.

IOP and PHP are crucial for those needing more than weekly therapy but not 24/7 hospitalization. Thrive Mental Health’s virtual programs are designed for this level of care and are covered by most major insurance plans.

How can I get therapy online with my Florida insurance?

Telehealth is now standard. Most mental health insurance Florida plans cover virtual therapy the same as in-person visits, with the same copays and deductibles. This applies to individual therapy, online psychiatry, and even virtual IOP and PHP programs.

Major Florida insurers like Florida Blue, Cigna, Aetna, and UnitedHealthcare offer robust telehealth coverage. To confirm your benefits, check your insurance portal or call member services. For a complete overview, see our guide to Florida virtual therapy.

Thrive’s virtual IOP and PHP programs offer intensive treatment with the flexibility to join from home. We work with most major insurance plans and verify your benefits upfront.

How to Find and Use Your Mental Health Insurance in Florida

Finding and using your mental health insurance Florida is manageable once you know where to look and what to ask.

If you’re shopping for a plan, start at HealthCare.gov. You can also use free Marketplace Navigators to help you compare plans. Once you have a plan, understanding your network is key. In-network providers have contracts with your insurer, meaning lower costs for you. Out-of-network providers do not, which results in higher out-of-pocket expenses.

Your plan type also matters. HMO plans are often cheaper but require referrals to see specialists. PPO plans offer more flexibility to see specialists without referrals, including out-of-network providers, but usually have higher premiums. Major insurers like Florida Blue, Cigna, Aetna, and UnitedHealthcare operate across Florida.

How do I choose the right mental health insurance Florida plan?

Choosing the right plan is about finding the best fit for your needs. Here’s a strategic approach:

- Assess Your Needs: Determine the level of care you anticipate needing (e.g., weekly therapy, IOP, PHP) and if you want to keep your current providers.

- Know Your Timeline: The Open Enrollment Period is typically Nov-Jan. Life events like losing a job or moving may qualify you for a Special Enrollment Period.

- Compare Plans on HealthCare.gov: Review the Summary of Benefits and Coverage for each plan. Focus on deductibles, copays, and the size of the provider network in your area.

- Verify Specific Coverage: If you need intensive treatment, confirm that IOP or PHP are covered benefits. We can help you verify this at Thrive Mental Health.

- Get Expert Help: Use free Marketplace Navigators or insurance brokers for impartial advice. You can also find resources for local insurance options.

How do I find a Florida therapist who takes my insurance?

Once you have a plan, follow these steps to find a provider:

- Check Your Insurer’s Provider Directory: Use the “Find a Doctor” tool on your insurance company’s website. For example, Florida Blue’s provider search tool lets you filter for mental health professionals.

- Call the Provider’s Office to Verify: This is a critical step. Directories can be outdated. Call the therapist’s office directly to confirm they accept your specific plan.

- Contact Your Insurer: Call the member services number on your card. They can provide a current list of in-network providers and confirm coverage details.

- Ask for Referrals: Your primary care physician can be a good source for referrals.

At Thrive Mental Health, we simplify this process by verifying your benefits for our IOP and PHP programs. You can verify your insurance in minutes on our site or by calling us at 561-203-6085.

Navigating Different Plans: Medicaid, Medicare, & Employer Coverage

Beyond the Marketplace, many Floridians get mental health insurance Florida through Medicaid, Medicare, or their job. Each has its own rules, but all provide strong mental health support.

What does Florida Medicaid cover for mental health?

Florida Medicaid provides a lifeline for low-income individuals, typically through Managed Medical Assistance (MMA) plans like Humana Healthy Horizons. Medicaid covers a comprehensive range of Community Behavioral Health Services, including:

- Assessments and screenings

- Individual, group, and family therapy

- Psychiatric services and medication management

- Substance use disorder treatment

- Targeted case management to help you steer the system

Many of these plans cover intensive services like the IOP and PHP programs offered at Thrive Mental Health. These services are considered minimum covered benefits for all MMA plans. For more details, see our resources on information on Medicaid therapy. Those eligible for both Medicare and Medicaid (“dual eligible”) can get even more comprehensive benefits. Learn more about details on Medicare mental health coverage.

How does my job’s insurance plan work for therapy?

Employer-sponsored plans are a common source of mental health insurance Florida coverage. If your company has 51 or more employees and offers mental health benefits, the Mental Health Parity and Addiction Equity Act (MHPAEA) requires those benefits to be equal to your medical benefits. This means your copays, deductibles, and treatment limits for therapy should be no more restrictive than for a physical health issue.

Most employer plans have an integrated deductible, meaning your therapy costs count toward your main medical deductible and out-of-pocket maximum. To understand your specific coverage, review your Summary of Benefits and Coverage (SBC) or call your insurer’s member services line. Look for details on copays and whether prior authorization is needed for programs like IOP or PHP.

At Thrive Mental Health, we regularly work with employer plans and can help you understand what your job’s insurance will cover for our programs.

When Coverage Fails: How to Fight Denials and Find Crisis Support

If you are in crisis or having thoughts of self-harm, call or text 988 immediately to connect with the Suicide & Crisis Lifeline. You are not alone.

A denial from your mental health insurance Florida provider is frustrating, but it’s not the final word. You have the legal right to challenge these decisions. At Thrive Mental Health, we frequently help clients overturn denials for IOP and PHP programs. The key is to be persistent and follow the process.

What do I do if my insurance denies a mental health claim?

A denial is the start of a process, not the end. Follow these steps:

- Understand the Denial: Your insurer must provide a written explanation. Common reasons are that a service wasn’t “medically necessary” or paperwork was incomplete. Knowing why is the first step to fighting back.

- File an Internal Appeal: You have 180 days from the denial date to ask the insurance company to reconsider. They must decide within 30 days for pre-service claims. If your health is at risk, you can request an expedited appeal, which is decided within 72 hours.

- Request an External Review: If the internal appeal fails, an independent third party will review your case. You have four months after the final internal denial to request this. A decision is typically made within 45 days (or 72 hours for urgent cases).

- File a Formal Complaint: If you believe your insurer is acting in bad faith, you can file a complaint with a regulatory agency.

- For commercial plans in Florida: Florida Department of Financial Services.

- For federal parity law issues: Department of Health and Human Services at 1-877-267-2323 ext. 6-1565.

- For employer self-insured plans: Department of Labor at www.askebsa.dol.gov.

- For Florida Medicaid issues: Agency for Health Care Administration at 1-877-254-1055.

Where can I get help in a mental health emergency?

In a crisis, immediate help is what matters most.

- Immediate Danger: If there is a risk of suicide or harm to yourself or others, call 911 or go to the nearest emergency room.

- Crisis Support: Call or text 988 anytime to connect with the free, confidential Suicide & Crisis Lifeline. You’ll speak with a trained counselor. Learn more at the National Suicide Prevention Lifeline.

- Insurance Crisis Lines: Many plans have dedicated 24/7 crisis lines. For example, Humana Healthy Horizons members can call the Carelon Behavioral Health Crisis Line at 844-265-7590. Check your insurance card for your plan’s number.

- Local Resources: Florida has local crisis stabilization units and mobile crisis teams. Search for “mental health crisis center near me” to find walk-in support.

Frequently Asked Questions about Mental Health Insurance in Florida

Here are quick, plain-language answers to the most common questions we hear about mental health insurance Florida.

Does all insurance in Florida have to cover mental health?

Mostly, yes. Under the Affordable Care Act (ACA), all plans sold on the Health Insurance Marketplace must cover mental health as an essential health benefit. While large employer plans aren’t required to offer it, if they do, the benefits must be on par with medical coverage (per the MHPAEA). Thrive Mental Health works with most major Marketplace and employer plans in Florida to provide covered IOP and PHP services.

How much does therapy cost with insurance in Florida?

Costs depend entirely on your plan. After meeting your annual deductible, you’ll typically pay a copay (a flat fee, like $20-$50) or coinsurance (a percentage of the cost, like 20%) for each session. For intensive care like our virtual IOP or PHP programs, the structure is similar. Always check your plan’s “Summary of Benefits and Coverage” for exact figures. Our team at Thrive can also verify your benefits and explain your costs in minutes.

Can my insurance deny me for a pre-existing mental health condition in Florida?

No. The ACA makes it illegal for any Marketplace plan to deny you coverage, charge you more, or refuse to pay for care because of a pre-existing condition. This includes depression, anxiety, PTSD, and substance use disorders. This protection starts on day one of your coverage, with no waiting periods. At Thrive Mental Health, we ensure this protection is upheld when you seek treatment at our Florida-based programs. If you believe you’ve been discriminated against, you can file a complaint with the Florida Department of Financial Services.

Conclusion

Navigating mental health insurance Florida is complex, but you now have the essential knowledge to advocate for yourself. You understand your rights under the ACA and MHPAEA, what your plan should cover, and how to fight back if a claim is denied. This is your pathway to recovery.

While the system can be frustrating, you don’t have to do it alone. At Thrive Mental Health, our team removes these barriers by verifying your benefits for our IOP and PHP programs and handling the insurance headaches. We help Floridians access structured, evidence-based care that fits their lives, with virtual and in-person options across the state.

Taking the first step is the hardest part, and you’re already doing it.

Ready for support? Thrive offers virtual and hybrid IOP/PHP programs with evening options designed for busy adults and young professionals. Verify your insurance in 2 minutes (no obligation) or call 561-203-6085. If you’re in crisis, call/text 988.