Your Path to Coverage: Navigating the Health Insurance Journey

Why Getting Health Insurance is Your First Step to Peace of Mind

Knowing how to get health insurance can feel overwhelming, but the process breaks down into just a few key steps:

Quick Steps to Get Health Insurance:

- Choose your path: Employer coverage, Healthcare.gov Marketplace, or government programs (Medicaid/Medicare)

- Know when to apply: Open Enrollment (November 1 – January 15) or during Special Enrollment Periods

- Gather documents: Income proof, Social Security numbers, and current insurance information

- Compare plans: Look at premiums, deductibles, and covered services

- Apply and pay: Submit your application and pay your first premium to activate coverage

Without health insurance, a single emergency room visit can cost thousands. With the average American paying over $12,000 annually for healthcare, insurance is essential for financial protection.

For busy professionals dealing with anxiety and depression, the right coverage means accessing mental health services when you need them most. Whether it’s therapy, medication, or intensive outpatient programs, insurance makes expensive treatments affordable.

The good news? Getting coverage is more straightforward than you think. Most people qualify for savings that can bring monthly premiums down significantly.

I’m Nate Raine, CEO of Thrive Mental Health. With over a decade in healthcare strategy and behavioral health, I’ve seen how the right coverage opens doors to life-changing treatment options.

Understanding Your Health Insurance Options

Once you understand your options, figuring out how to get health insurance becomes much clearer. Your main routes to coverage fall into three categories: public plans (government-funded), private plans (often through an employer), and individual market plans (purchased yourself). For Florida residents, the individual market usually means shopping on the federal marketplace at Welcome to the Health Insurance Marketplace® | HealthCare.gov.

No matter which path you choose, you’ll have access to essential mental health services, which is vital for busy professionals who need reliable access to therapy, medication management, or more intensive support.

Public Health Plans

Government-funded programs act as a safety net for millions of Americans, often providing comprehensive coverage, including mental health services.

Medicaid is the largest public health program, offering free or low-cost coverage to eligible low-income individuals and families. In Florida, eligibility depends on income, family size, and other factors like pregnancy or disability. Medicaid covers extensive mental health services, from therapy to intensive treatment. Learn more at Medicaid Covered Therapy.

The Children’s Health Insurance Program (CHIP), known as Florida KidCare in Florida, fills the gap for families who earn too much for Medicaid but still need help covering their children.

Medicare primarily serves adults 65 and older, plus some younger people with disabilities. This federal program has different parts (A, B, C, and D) that cover everything from hospital stays to prescriptions.

Private Health Plan Types

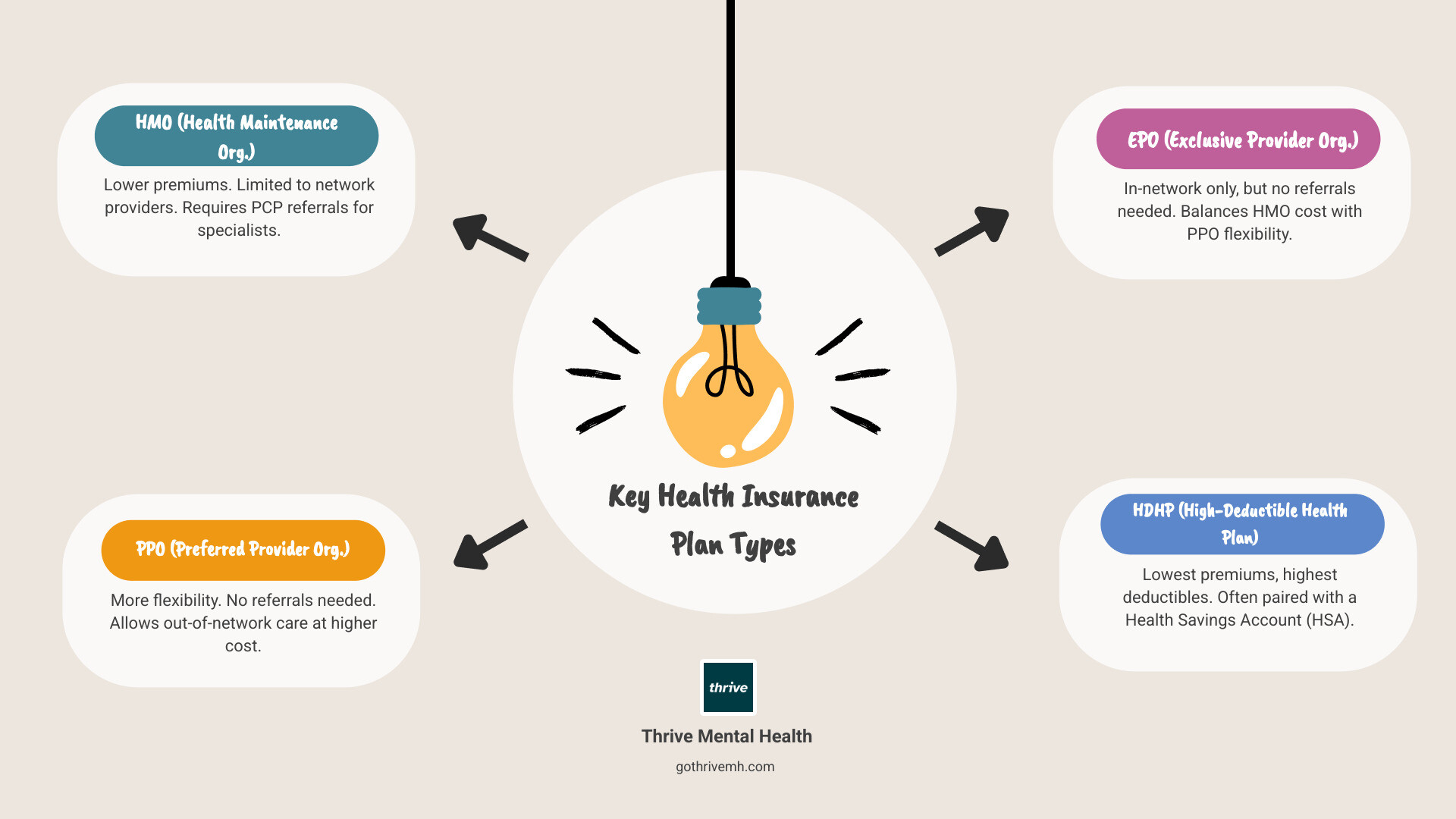

Private insurance offers more choice, though often at a higher cost. Understanding the plan types helps you pick the right fit.

Health Maintenance Organizations (HMOs) require you to use a specific network of doctors and get referrals from a primary care physician (PCP) to see specialists. This structure keeps costs lower but offers less flexibility.

Preferred Provider Organizations (PPOs) offer more flexibility. You can see specialists without a referral and go to out-of-network doctors, though you’ll pay more. PPOs are for those who value choice and are willing to pay higher premiums.

Point of Service (POS) plans are a hybrid. Like an HMO, you have a PCP, but like a PPO, you can go out-of-network with a referral.

Exclusive Provider Organizations (EPOs) don’t require referrals to see in-network specialists, but they don’t cover out-of-network care (except in emergencies).

High-Deductible Health Plans (HDHPs) have low monthly premiums but high upfront costs (the deductible) when you need care. They are often paired with a tax-free Health Savings Account (HSA).

Here’s how the two most popular options stack up:

| Feature | Health Maintenance Organization (HMO) | Preferred Provider Organization (PPO) |

|---|---|---|

| Network | Limited to a specific network of doctors and hospitals. | Wider network of preferred providers, plus out-of-network options. |

| Primary Care Provider (PCP) | Required; acts as your gatekeeper for referrals. | Not usually required. |

| Referrals | Required for specialists. | Not usually required for specialists. |

| Out-of-Network | No coverage (except emergencies). | Covered, but at a higher cost. |

| Premiums | Generally lower. | Generally higher. |

| Flexibility | Less flexible, more structured. | More flexible, more choice. |

The key is matching your plan type to your lifestyle. If you want to keep costs low, an HMO or HDHP might work. If you need flexibility, a PPO could be worth the extra cost.

How to Get Health Insurance: A Step-by-Step Guide

Getting health insurance is a manageable process once you know the timeline and what paperwork you need. Let’s walk through exactly how to get health insurance.

Step 1: Know When You Can Enroll

Timing is key for health insurance enrollment.

Open Enrollment Period is your main window to sign up or switch plans, running from November 1 to January 15 for 2025 coverage. To get coverage starting January 1, enroll by December 15. If you enroll by January 15, your coverage will begin February 1. As Healthcare.gov advises: Act now for health coverage in 2025.

Special Enrollment Periods (SEPs) are available if you have a major life change outside of Open Enrollment. Most SEPs give you 60 days to enroll after a qualifying event, such as:

- Losing job-based health coverage

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new ZIP code or county

- A significant change in household income

- Becoming a U.S. citizen

Step 2: Gather Your Information and Apply

When you’re ready, you can apply online at Apply for Health Insurance | HealthCare.gov. Have these documents ready:

- Social Security numbers for everyone on the application

- Income information (pay stubs, tax returns)

- Details about any current health insurance

- Information about any employer-sponsored insurance available to your household

- Immigration documents, if applicable

The application will guide you through what’s needed, and help is available if you get stuck.

Step 3: How to get health insurance in Special Situations

Here’s how to handle some common scenarios:

- Self-employed options: The Health Insurance Marketplace is typically your best bet. Individual plans through Healthcare.gov often provide better value than COBRA.

- Losing job-based coverage: This triggers a Special Enrollment Period. You can choose COBRA to keep your old plan (but you pay the full, often expensive, premium) or shop for a more affordable Marketplace plan, where you might qualify for tax credits.

- New Florida residents: Moving to Florida qualifies you for a Special Enrollment Period, giving you 60 days to enroll in a new plan. You’ll need to provide proof of your new Florida address.

- Options for new immigrants: Eligibility for Marketplace coverage varies by immigration status. The Healthcare.gov application will determine your options based on your specific situation.

Choosing the Right Plan for Your Needs and Budget

After applying, you’ll see a menu of health plan options. The goal is to find one that fits your health needs and budget. Understanding how to get health insurance that works for you is crucial.

All plans on the How to get insurance through the ACA Health Insurance Marketplace cover 10 essential health benefits and cannot deny you coverage for pre-existing conditions.

Decoding the Costs

Understanding key terms makes comparing costs easier:

- Premium: Your fixed monthly payment to keep your plan active.

- Deductible: The amount you pay for covered services before your insurance starts paying.

- Copayment (Copay): A fixed fee you pay for a specific service, like a doctor’s visit.

- Coinsurance: The percentage of costs you share with your insurance company after meeting your deductible.

- Out-of-Pocket Maximum: The most you’ll have to pay for covered services in a plan year. It’s your financial safety net.

Costs are influenced by your age, location in Florida, and plan type (HMOs are often cheaper than PPOs).

What’s Covered? Essential Benefits and Pre-Existing Conditions

Thanks to the Affordable Care Act (ACA), every marketplace plan must cover these 10 essential health benefits:

- Outpatient care (doctor visits)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Laboratory services

- Preventive and wellness services (often free)

- Pediatric services, including oral and vision care

The ACA also protects you from being denied coverage or charged more due to pre-existing conditions like diabetes or depression.

How to get health insurance that fits your life

To choose the right plan, look beyond the premium:

- Compare total costs: Use Healthcare.gov to compare plans side-by-side. A plan with a higher premium but lower deductible might be cheaper overall if you need frequent care.

- Check for your doctors: If you have a trusted doctor or therapist, make sure they are in the plan’s network, especially for HMO or EPO plans.

- Review drug formularies: If you take regular medications, check the plan’s list of covered drugs (formulary) to see how much your prescriptions will cost.

- Estimate yearly costs: Add up your expected premiums and out-of-pocket expenses to get a true sense of what each plan will cost you annually.

Florida residents can also explore options from local providers like Florida Blue: Florida Health Insurance Plans directly or through the Marketplace.

Securing Coverage for Your Mental Health

At Thrive Mental Health, we know that finding mental health support is a top priority. Your health insurance is a powerful tool for accessing that care.

Thanks to mental health parity laws, most health plans must cover mental health and substance use disorder services at the same level as medical care. This means your therapy session should have similar coverage and costs to a regular doctor’s visit.

Your insurance can make treatment for anxiety, depression, and other challenges affordable. This includes individual therapy and more intensive options like our intensive outpatient (IOP) or partial hospitalization (PHP) programs. We’ve created guides to help you steer specific plans, such as Blue Cross Blue Shield and Aetna: What You Should Know About Mental Health Benefits and Exploring Mental Health Resources with Cigna and UnitedHealthcare.

The most important thing to remember is that you don’t have to figure this out alone. Our team at Thrive Mental Health can help verify your benefits and guide you.

Is Virtual Therapy Covered by Insurance?

Yes! Most major insurance providers now offer strong coverage for telehealth, making virtual therapy both convenient and affordable. This is a game-changer for busy professionals or those in parts of Central Florida with limited access to in-person specialists.

Many members with major insurance plans pay copays of $30 or less for virtual therapy. Virtual intensive outpatient programs are also covered by most major insurers. At Thrive Mental Health, our virtual IOP brings expert-led care to your home, whether you’re in Tampa Bay, St. Petersburg, or anywhere else in Florida. Virtual care eliminates travel time and offers flexible scheduling. Learn more in our guide to Virtual IOP Insurance.

Finding a Therapist or Program That Takes Your Insurance

Here’s how to find a provider who accepts your plan:

- Start with your insurer’s provider directory: Use your insurance company’s website to find in-network providers. You can filter by specialty, location (including virtual), and conditions treated.

- Verify coverage directly: Call your insurance company and ask specific questions: Is this provider in-network? What are my copay and deductible for mental health services? Are there limits on the number of sessions?

- Ask about specific treatments: If you’re interested in a specific therapy like Dialectical Behavior Therapy (DBT), confirm it’s covered. Our guide on Maximizing Your Aetna Benefits for Dialectical Behavior Therapy (DBT) can help.

- Reach out to the provider: Our team at Thrive Mental Health can verify your benefits for you, providing an estimate of your costs before you even start. We handle the legwork so you can access care without financial surprises.

Frequently Asked Questions about Getting Health Insurance

Here are straightforward answers to some common questions about how to get health insurance.

What if I have a pre-existing medical condition?

Thanks to the Affordable Care Act (ACA), insurance companies cannot stop you from getting health insurance or charge you more because of a pre-existing condition. Whether you have anxiety, depression, diabetes, or another condition, your premium is based on factors like age and location, not your health history. This protection applies to all Marketplace plans and has been a game-changer for accessing mental health care.

How much does health insurance cost?

The cost depends on your age, location in Florida, the plan type you choose, and family size. However, most people qualify for significant savings through premium tax credits and cost-sharing reductions. These subsidies are based on your household income and can dramatically lower your monthly premium and out-of-pocket costs. Always check your eligibility for financial assistance on the Marketplace.

What if I miss the Open Enrollment deadline?

You still have options. Special Enrollment Periods (SEPs) are available if you experience a qualifying life event like losing job-based coverage, getting married, or moving. You can also apply for Medicaid and CHIP year-round if your income qualifies. Short-term plans are a last resort; they don’t have to follow ACA rules and may not cover pre-existing conditions or essential benefits like mental health, so use them with caution.

Conclusion

Understanding how to get health insurance is about giving yourself the gift of security and peace of mind. By breaking the process down into manageable steps, the journey transforms from a confusing maze into a clear pathway to coverage that fits your life and budget.

For busy professionals in Florida dealing with stress, anxiety, or depression, the right insurance means accessing life-changing care. Virtual therapy, intensive outpatient programs, and specialized treatments like DBT are no longer luxuries; they are accessible, affordable options with proper coverage.

At Thrive Mental Health, we’ve seen how the right insurance opens doors to healing. When you don’t have to worry about massive therapy bills, you can focus on what really matters: getting better.

You’re not just buying an insurance plan—you’re investing in a safety net that protects your physical, mental, and financial wellbeing. You’re ensuring that when life gets tough, you have the support you need to bounce back stronger.

Don’t let uncertainty hold you back. Take control of your health journey today by exploring your options on the Healthcare.gov Marketplace, with your employer, or through public programs.

If you’re ready to take the next step in your mental wellness journey, we’re here to help you explore how therapy can fit into your new healthcare plan: Take the next step in your mental wellness journey by exploring therapy options. Your healthier, more secure future starts now.