Who’s Who in Health Insurance: A Comprehensive Look at Leading Providers

Why Choosing the Right Health Insurance Company Matters

Health insurance companies provide essential financial protection and access to healthcare in Florida. Making the right choice can save you thousands of dollars while ensuring you get the care you need, especially when it comes to mental health services.

Leading providers like Blue Cross Blue Shield, UnitedHealthcare, Aetna, Cigna, and Florida Blue each offer unique plans, networks, and benefits. Whether you’re shopping during Open Enrollment or navigating a life change, understanding how these companies operate is key to making an informed decision.

Mental health coverage is a critical factor. Many plans now cover therapy and psychiatric services, making treatment for conditions like anxiety and depression more accessible and affordable.

I’m Nate Raine, CEO of Thrive Mental Health. My work in healthcare innovation and behavioral health has shown me how health insurance companies shape access to care. This guide leverages that insight to help you steer your options.

Understanding Your Health Insurance Options

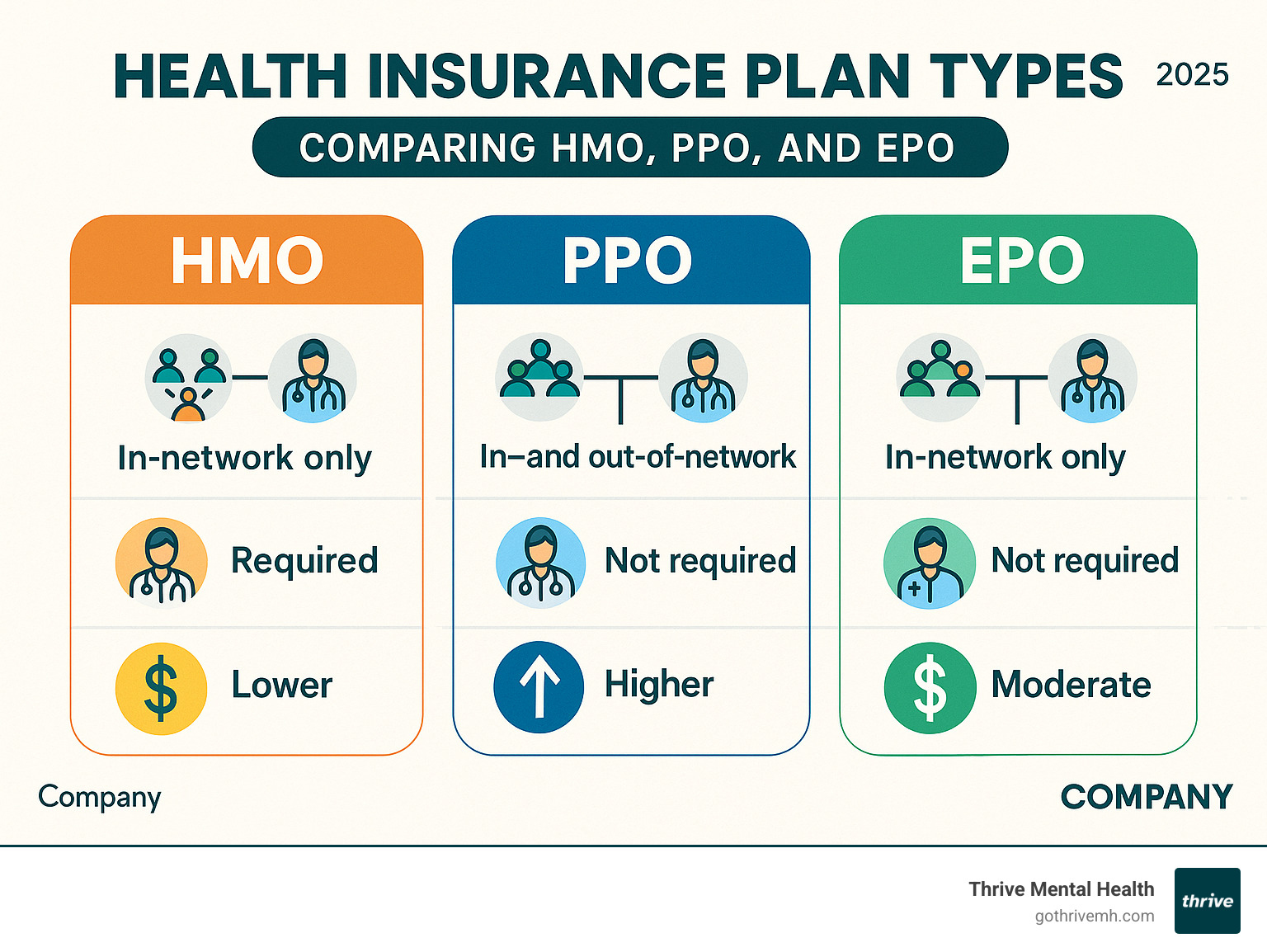

Choosing health insurance is easier once you understand the basic plan types. Each offers a different balance of flexibility and cost.

- Health Maintenance Organization (HMO): These plans typically have lower premiums. You choose a primary care provider (PCP) who manages your care and provides referrals to in-network specialists. Care outside the network is generally not covered.

- Preferred Provider Organization (PPO): PPOs offer more flexibility. You don’t need a PCP or referrals to see specialists. You can see out-of-network providers, but you’ll pay more than you would for in-network care.

- Exclusive Provider Organization (EPO): An EPO is a hybrid. You don’t need referrals for specialists, but you must use doctors and hospitals within the network (except in emergencies).

- Point of Service (POS): POS plans combine features of HMOs and PPOs. They often require a PCP and referrals but allow you to go out-of-network for a higher cost.

You can get coverage through Marketplace plans (via the Affordable Care Act) or employer-sponsored plans. Understanding the financial terms is also crucial:

- Premium: Your fixed monthly payment to keep your plan active.

- Deductible: The amount you pay for covered services before your insurance starts to pay.

- Copay: A fixed fee for a specific service, like a doctor’s visit.

- Coinsurance: The percentage of costs you pay after your deductible is met.

- Out-of-Pocket Maximum: The most you’ll have to pay for covered services in a plan year.

For more guidance on finding plans that fit your budget, check out our affordable health plans resource.

What Health Insurance Typically Covers

Most comprehensive plans from health insurance companies cover essential services, though specifics vary. Preventive care, like annual checkups and screenings, is often covered at 100%.

- Prescription drug coverage is usually tiered, with generic drugs being the most affordable. Plans may cover a percentage of drug costs up to an annual limit.

- Hospital stays and emergency services are fundamental protections, shielding you from catastrophic costs during a medical crisis.

- Mental health services are increasingly recognized as essential. At Thrive Mental Health, we see how this plays out. Many leading health insurance companies now cover therapy, psychiatry, and specialized programs like our intensive outpatient (IOP) and partial hospitalization (PHP) programs. This makes care for anxiety, depression, and other conditions more accessible.

- Vision and dental care are often included in comprehensive plans or available as add-ons, covering exams, glasses, cleanings, and other restorative services.

To learn more about how health insurance can support your mental wellness journey, explore our article on the Benefits of Health Insurance Covering Mental Health Services.

Special Coverage Considerations

Sometimes, you may need specialized coverage beyond a standard plan.

- Short-term health insurance can bridge gaps in coverage, such as when you’re between jobs. These plans offer basic protection but are less comprehensive and don’t cover pre-existing conditions.

- Travel medical insurance is vital for trips, especially internationally, as your regular plan may offer limited or no coverage abroad.

- Supplemental insurance pays cash benefits directly to you for specific events like accidents, critical illnesses (cancer, heart attack), or hospital stays. This money can help cover deductibles, lost income, or other expenses.

A Guide to Leading Health Insurance Companies in Florida

Florida’s health insurance market offers a rich variety of options. For residents in Tampa Bay, St. Petersburg, and across Central Florida, understanding the major health insurance companies is key to finding the right coverage. When comparing providers, look beyond the premium to consider plan variety, network size, member services, and digital tools. These factors determine the quality of your healthcare experience.

For those specifically interested in Florida’s major players, our A Comprehensive Guide to Aetna, Florida Blue, and Evernorth Plans dives deep into what each provider offers.

Comparing Plans from Top Health Insurance Companies

Let’s look at how leading health insurance companies in Florida compare.

- Florida Blue: As the state’s Blue Cross Blue Shield affiliate, Florida Blue has the largest market share and a deep understanding of the local healthcare landscape. Their plans feature strong local networks and a commitment to community health.

- Aetna: Aetna offers a powerful focus on mental health, with plans often covering a wide range of services with low copays. They are an excellent choice for those prioritizing mental wellness.

- Cigna: Cigna takes a holistic approach, offering robust virtual care options, often starting at $0 for preventive and minor acute care. Their myCigna portal provides 24/7 access to member resources.

- UnitedHealthcare: As a major national insurer, UnitedHealthcare provides an extensive array of plans. They focus on simplifying the healthcare experience and are particularly strong in promoting preventive care.

Member satisfaction varies, so it’s important to find a provider whose approach aligns with your needs.

To see how Florida Blue is staying ahead of the curve, check out How Florida Blue is Revolutionizing Health Insurance. And if mental health coverage is important to you, don’t miss our guide on Exploring Mental Health Resources with Cigna and UnitedHealthcare.

What to Look for in Florida-based Health Insurance Companies

When choosing a plan in Florida, pay attention to these unique factors:

- Local Network Strength: Ensure the plan has a robust network of doctors and hospitals in your specific area, whether it’s Miami-Dade, Tampa Bay, or a smaller community.

- Access to Top Hospitals: Check if the plan provides access to Florida’s leading medical centers, like Mayo Clinic in Jacksonville or Tampa General Hospital, especially if you need specialized care.

- State-Specific Programs: Look for wellness initiatives or partnerships with local healthcare systems offered exclusively to Florida residents.

- Customer Service Reputation: Research providers with strong reputations for helpful and knowledgeable support, particularly those with local service centers.

For a broader perspective on the insurance industry, the List of United States insurance companies – Wikipedia provides comprehensive information about providers nationwide.

Key Factors When Choosing Your Plan

When selecting a plan from one of Florida’s health insurance companies, a personal needs assessment is the first step. Consider your current health, any ongoing conditions, and what you might need in the coming year. Are you a frequent visitor to the doctor, or do you rarely go? Your answers will shape your coverage needs.

Budgeting for healthcare means looking beyond the monthly premium. A low-premium plan might have a high deductible, meaning you pay more out-of-pocket when you need care. The goal is to balance premiums and deductibles. If you’re healthy and have savings, a high-deductible plan might work. If you prefer predictable costs, a higher premium for lower out-of-pocket expenses could be better.

For a detailed comparison that might help with your decision, check out our article: Which Is Better For You: Aetna or UnitedHealthcare?.

Coverage and Network

Once you know your needs, dig into the details of coverage and network, where health insurance companies differ most.

- In-Network vs. Out-of-Network: In-network providers have pre-negotiated rates with your insurer, so you pay less. Going out-of-network costs more, and your plan may not cover it at all. A strong local network in areas like Tampa Bay or St. Petersburg is a major plus.

- Specialist Access: Some plans require a referral from your primary doctor to see a specialist, while others let you go directly. If you need regular specialist care, this flexibility is key.

- Prescription Drug Formulary: This is your plan’s list of covered medications, organized into cost tiers. Generics are usually cheapest.

- Mental Health Coverage: This is crucial. Many health insurance companies now offer robust coverage for therapy, psychiatry, and intensive programs like the IOP and PHP services we provide at Thrive Mental Health. Insurers like Aetna often cover online therapy with minimal copays, making care for anxiety and depression more accessible.

For more specific information about mental health coverage options, read our article: Understanding Insurance Coverage for Dialectical Behavior Therapy: Blue Cross Blue Shield vs. UnitedHealthcare.

Cost and Customization

Understanding the financial side of your plan helps you budget effectively.

- Monthly Premiums: Your fixed payment to keep coverage active.

- Annual Deductibles: The amount you pay before your insurance begins to share costs.

- Copayments and Coinsurance: After your deductible, you’ll pay either a fixed copayment for services or a percentage-based coinsurance.

- Plan Flexibility: Some providers allow you to customize coverage, adding or removing benefits to fit your needs.

- Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA): These accounts let you use pre-tax dollars for healthcare costs. HSAs are paired with high-deductible plans, while FSAs are typically offered by employers.

Pre-Existing Conditions

The Affordable Care Act (ACA) brought significant protections for those with pre-existing conditions.

Health insurance companies can no longer deny you coverage or charge you more for conditions like diabetes, heart disease, or mental health issues. This applies to both individual and employer plans. Guaranteed issue plans must accept you regardless of health status. Special Enrollment Periods allow you to sign up for a plan outside of the normal window if you have a qualifying life event, like getting married or losing other coverage.

Understanding your rights is empowering. You cannot be dropped from coverage or denied essential benefits because of your health status, ensuring mental health is treated with the same importance as physical health.

For more detailed information about your coverage options and rights, explore our guide on More about your insurance policy.

Frequently Asked Questions about Health Insurance

Navigating health insurance companies can be confusing, but you’re not alone in having questions. Answering them is the first step toward feeling confident about your coverage. Here are some of the most common queries we hear.

How do I get a health insurance quote and apply for a plan?

Getting started is simpler than you might think. Floridians can use the federal online marketplace at Healthcare.gov during the Open Enrollment period (typically Nov. 1 to Dec. 15). You can also get quotes directly from insurers that serve Florida, like Aetna, Cigna, or Florida Blue, on their websites. Alternatively, using a broker can be helpful; their services are usually free to you, as they are paid by the insurance companies.

If you miss Open Enrollment, you may qualify for a Special Enrollment Period if you have a life event like marriage or job loss. When applying, have personal details, income information, and Social Security numbers ready for a smoother process.

For step-by-step guidance through this process, check out our comprehensive guide: How to Get Health Insurance.

Is personal health insurance worth it if I’m healthy?

Yes, absolutely. In Florida, where healthcare costs can be high, health insurance is a crucial investment even when you’re healthy. Think of it as protection for both your health and your finances.

Most plans cover preventive care benefits like annual check-ups and screenings at no extra cost, helping you catch issues early. It also provides a financial safety net against unexpected accidents or illnesses, which can lead to devastating medical bills. Many health insurance companies also offer access to wellness programs, such as gym discounts and stress management resources, to help you maintain your well-being. Investing in health insurance is one of the smartest financial decisions you can make.

How does insurance cover virtual therapy and telehealth?

In Florida, virtual care is more accessible than ever, with most health insurance companies now offering robust coverage for telehealth services.

Post-pandemic policies have largely maintained this expanded coverage for mental health counseling, psychiatric evaluations, and medication management. In-network virtual providers are now widely available. For example, some Cigna plans offer virtual care starting at $0. Many major insurers work directly with virtual mental health platforms, making these services highly accessible.

The copay for virtual visits is often the same as or lower than in-person visits. Some Aetna and Cigna members may pay as little as $0 to $20 per session. This affordability removes a major barrier to getting support.

At Thrive Mental Health, our virtual IOP and PHP programs work seamlessly with insurance. Always check your plan’s specific benefits for details on behavioral health coverage and telehealth session limits.

For more details on how UnitedHealthcare specifically supports virtual mental health services, read our article: United Healthcare Virtual Therapy.

Conclusion

Choosing the right health insurance plan is a critical decision for your health and financial security. By understanding the different health insurance companies, plan types, and key factors like network and cost, you can find coverage that truly fits your life.

Prioritizing mental wellness is more accessible than ever, thanks to expanded coverage for virtual therapy and evidence-based treatments. When health insurance companies cover effective mental health care, it removes barriers and allows people to get the support they need.

At Thrive Mental Health, we see how proper insurance transforms access to care. Our virtual and in-person IOP and PHP programs work with major insurers to provide expert-led treatment throughout Florida, including Tampa Bay, St. Petersburg, and Central Florida. The right coverage lets you focus on your healing journey, not the cost.

Your health insurance choice empowers your entire wellness journey. It’s your gateway to preventive care, emergency services, and the mental health support that helps you thrive.

Ready to explore how your insurance can work with quality mental health care? Find flexible and expert-led therapy options that align with your coverage and support your path to wellness.