Your Mental Health Policy: A Step-by-Step Guide to Reading Your Benefits

How to read mental health insurance benefits: 4 Key Steps

Stop Overpaying for Therapy: How to Read Mental Health Insurance Benefits in 4 Steps [Save $500+ Fast]

If you’re in crisis, call/text 988 right now. You are not alone.

Summary: Learn how to read mental health insurance benefits in 4 clear steps so you can cut costs, avoid denials, and use your coverage with confidence.

Learning how to read mental health insurance benefits isn’t just about paperwork—it’s about accessing the care you need without breaking the bank. More than half of Americans report that mental health treatment costs are a major barrier to getting help, yet many people never fully understand what their insurance actually covers.

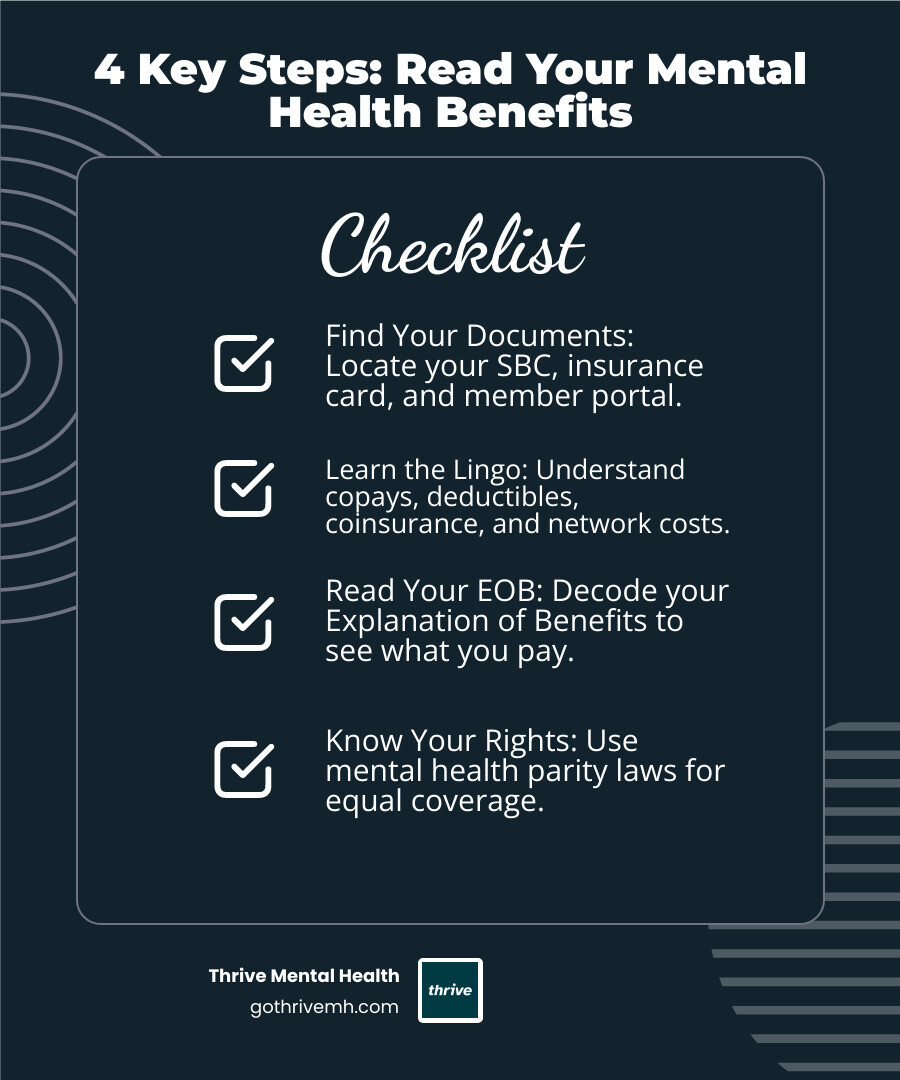

Here’s how to read your mental health insurance benefits in 4 key steps:

- Find Your Documents – Locate your Summary of Benefits and Coverage (SBC), insurance card, and member portal login

- Learn the Lingo – Understand copays, deductibles, coinsurance, and in-network vs. out-of-network costs

- Read Your EOB – Decode your Explanation of Benefits to see what you actually pay

- Know Your Rights – Use mental health parity laws to ensure equal coverage

The Mental Health Parity and Addiction Equity Act requires that mental health benefits can’t be more restrictive than medical coverage. The Affordable Care Act mandates that most plans cover mental health services. You have legal protections—but only if you know how to use them.

Many people overpay for care or skip it entirely because they don’t understand their benefits. The truth is, once you know how to steer your plan, accessing care becomes much more manageable.

As Anna Green, LMHC, LPC, and Chief Clinical Officer at Thrive Mental Health, I’ve seen that knowing how to read mental health insurance benefits is often the difference between getting care and going without it. My team has helped thousands of patients across Florida understand their insurance to access our intensive outpatient and partial hospitalization programs.

Basic how to read mental health insurance benefits vocab:

- benefits of health insurance covering mental health services

- medicaid covered psychiatrist

- medical insurance cover therapy

First Steps: Locating Your Key Plan Documents

Gathering your insurance documents is the first step to understanding how to read mental health insurance benefits. Fortunately, these documents are easier to find than you might think.

Your Summary of Benefits and Coverage (SBC) is like the CliffsNotes version of your insurance plan. This standardized document breaks down what your plan covers, what it costs, and defines confusing terms in plain English. If you can’t find yours, check your insurance company’s website or call them to request a new copy.

The Evidence of Coverage (EOC) is the full, detailed contract that spells out everything your plan includes and excludes. While it can be long, it’s the ultimate reference guide for specifics.

Your insurance card might look simple, but it’s packed with useful information. Beyond your member ID and group number, flip it over and look for separate phone numbers labeled “Behavioral Health” or “Mental Health Services.” These specialized lines can save you time by connecting you directly with representatives who understand mental health coverage.

Don’t overlook your online member portal. Once you’re logged in, you can view your documents, track claims, find providers, and get personalized benefit information without waiting on hold.

If you get insurance through work, your HR department can be a helpful resource. They often have copies of plan documents and can explain general benefits, including extra perks like Employee Assistance Programs that offer free counseling sessions.

For a comprehensive overview of what to look for in your plan documents, check out this guide to your plan’s summary of benefits.

Finding Your Mental Health Coverage Information

Once you’ve gathered your documents, it’s time to dig into the mental health specifics.

First, don’t get confused by the terminology. Insurance companies often use the term “behavioral health” to cover both mental health and substance use services. When you see “behavioral health” on your documents, that’s your mental health coverage.

The fastest way to get clear answers is to call your insurer. Use that behavioral health number on your card if you have one. Come prepared with specific questions rather than just asking “what’s covered?”

Ask about the basics first: Does your plan cover therapy and psychiatric care? What are your out-of-pocket costs for in-network versus out-of-network providers? Do you have a deductible, copay, or coinsurance for mental health services?

Then get into the details: Are there session limits or dollar caps? Is teletherapy covered at the same rate as in-person visits? Do you need a referral from your primary care doctor or prior authorization? What’s your out-of-pocket maximum for mental health services?

Document everything. Write down the date, time, representative’s name, and their answers. Ask for a reference number. This documentation becomes crucial if you run into billing issues later.

Your online member portal often has a goldmine of information without the phone wait. Many portals let you estimate costs, check your deductible status, and search for in-network mental health providers in your area—whether you’re in Miami, Orlando, or anywhere else in Florida.

Being methodical is key to understanding how to read mental health insurance benefits. Gathering documents and asking targeted questions upfront can save you significant money and confusion.

Decoding the Jargon: Key Mental Health Insurance Terms Explained

Understanding insurance language directly impacts your wallet and access to care. When figuring out how to read mental health insurance benefits, these key terms are your building blocks.

The three most important cost terms work together. Your deductible is the amount you pay out-of-pocket before your insurance kicks in—think of it as your annual “entry fee” to coverage. A copay is a fixed amount you pay each time you use a service, like paying $30 for every therapy session. Coinsurance is when you split the cost with your insurance company after you’ve met your deductible—for example, you might pay 20% while they cover 80%.

Here’s how this plays out with a $150 therapy session: If you have a $500 deductible that you haven’t met yet, you’d pay the full $150. But once your deductible is satisfied, you might only pay a $30 copay or 20% coinsurance ($30), depending on your plan structure.

In-network providers have contracts with your insurance company, which means lower costs for you. Out-of-network providers don’t have these agreements, so you’ll typically pay significantly more. Your insurance company maintains a directory of in-network providers, though these “ghost networks” aren’t always accurate.

Your out-of-pocket maximum is a safety net: the most you’ll pay in a year for covered services before insurance covers 100%. This includes deductibles, copays, and coinsurance, but usually not your monthly premiums.

Prior authorization means your insurance company wants to approve certain treatments before you receive them. This is becoming less common for routine mental health services thanks to parity laws.

The allowed amount is what your insurance considers a “reasonable” charge for a service. If your therapist charges $200 but your plan’s allowed amount is $150, you might be responsible for that $50 difference if you’re seeing an out-of-network provider.

| Term | Definition | Example for a $150 Therapy Session |

|---|---|---|

| Copay | A fixed amount you pay for covered services after you meet your deductible | You pay $30 per session regardless of the therapist’s actual fee |

| Deductible | The amount you must pay out-of-pocket before your insurance starts paying | If you have a $500 deductible and haven’t met it, you pay the full $150 |

| Coinsurance | The percentage you pay for services after meeting your deductible | With 20% coinsurance, you pay $30 while insurance covers $120 |

These terms may seem overwhelming, but knowing which ones apply to your plan is key to managing your mental health care costs.

For a complete reference, check out the official Glossary of Health Coverage and Medical Terms. And if you’re working with specific insurers, our guide on Navigating Mental Health Support with Aetna and UnitedHealthcare can help you understand how these terms apply to your particular situation.

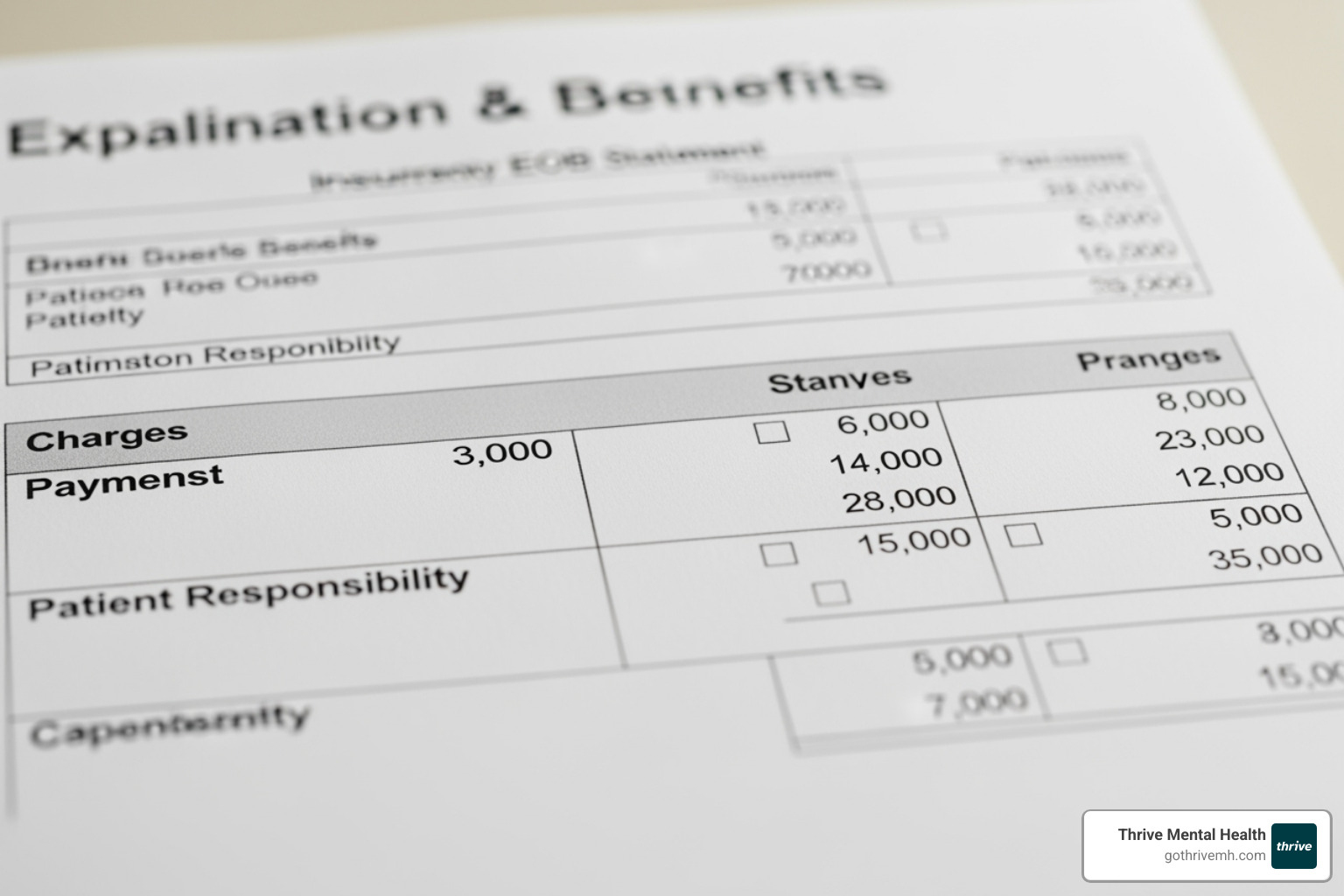

How to Read Mental Health Insurance Benefits on Your EOB

Once you’ve received mental health services, your insurance company will send you an Explanation of Benefits (EOB). This isn’t a bill, but a report from your insurer showing what they paid and what you owe. Learning how to read mental health insurance benefits on your EOB is like having a translator for insurance speak.

Your EOB might look intimidating, but each section tells part of your cost story. The Amount Billed shows what your therapist originally charged—let’s say $150. If your provider is in-network, you’ll see a Plan Discount. This is the pre-negotiated rate your therapist accepts from your insurer. You are never responsible for paying this discounted amount.

The Allowed Amount is what your insurance considers reasonable for the service—usually the original charge minus any discount. The Applied to Deductible section shows how much of this cost counts toward your annual deductible. Until you meet your deductible, you typically pay the full allowed amount.

If you have a Copay for mental health services, it’ll appear here as a fixed amount. Coinsurance kicks in after you’ve met your deductible—this is your percentage of the remaining cost. With 20% coinsurance, you’d pay $24 of that $120 allowed amount while your insurance covers $96.

The Amount Paid by Plan shows exactly what your insurance company sent to your provider. Your Patient Responsibility is the bottom line—what you actually owe. Remark Codes at the bottom explain processing decisions that affect your costs.

If you want to see a real example, this sample EOB statement walks through each section in detail.

What Specific Mental Health Services Are Covered?

Most plans now cover a wide range of mental health services. Knowing what’s included helps you plan your care and budget.

Outpatient therapy forms the backbone of most mental health coverage. This includes individual sessions, group therapy, couples counseling, and family therapy. Most evidence-based approaches like Cognitive Behavioral Therapy (CBT) or Dialectical Behavior Therapy (DBT) are typically covered.

For people needing more intensive support, Intensive Outpatient Programs (IOP) provide structured treatment several hours a day, multiple days a week, while allowing you to maintain your daily routine. Partial Hospitalization Programs (PHP) offer even more comprehensive care, often serving as an alternative to inpatient treatment. Learn more about Thrive’s programs: Intensive Outpatient Program (IOP) and Partial Hospitalization Program (PHP).

Teletherapy and virtual sessions have become standard coverage since the pandemic. Coverage can vary, so always verify your specific teletherapy benefits. Our Virtual IOP Insurance page has more details about virtual care coverage.

Medication management with psychiatrists or other prescribing professionals is typically well-covered, including both diagnostic evaluations and ongoing medication monitoring. Psychiatric services extend beyond prescriptions to include comprehensive assessments and treatment for complex mental health conditions.

Coverage specifics can vary significantly between insurers. If you have Cigna, Florida Blue, or Optum, your benefits might look different from someone with a different carrier. Most services require a “medical necessity” determination from a licensed professional.

How to read mental health insurance benefits for in-network vs. out-of-network providers

Understanding the distinction between in-network and out-of-network providers is crucial when learning how to read mental health insurance benefits.

In-network providers have signed contracts with your insurance company, agreeing to accept negotiated rates. This means predictable costs for you—typically just your copay, deductible, and coinsurance.

Out-of-network providers don’t have a contract with your insurance. You’ll likely pay more, often upfront, and then submit a claim for partial reimbursement.

The financial impact is significant. With an in-network therapist, you might pay a $30 copay per session. That same care from an out-of-network provider charging $150 could cost you $75 or more if your plan only covers 50% after your deductible.

Most insurance companies provide online provider directories, but these aren’t always accurate, creating “ghost networks”—listings for providers who aren’t accepting new patients or are no longer in-network. It may take several calls to find an available in-network provider.

If you see an out-of-network provider, they might give you a superbill—a detailed invoice with all the information your insurance company needs to process your reimbursement claim. You’ll pay the provider directly, then submit the superbill to get money back.

Provider networks can vary significantly between regions, so if you’re in Florida cities like Miami, Tampa, or Jacksonville, always confirm a provider’s network status directly with both their office and your insurance company.

Your Rights and Next Steps: Parity, Denials, and Finding Care

If you’re in crisis, call or text 988 right now. You are not alone.

Understanding your rights is a critical part of learning how to read mental health insurance benefits. The good news is that federal laws are on your side.

The Mental Health Parity and Addiction Equity Act (MHPAEA) is your biggest ally. This 2008 law requires most health plans to treat mental health and substance use disorder benefits the same way they treat medical and surgical benefits.

Here’s what this means in real terms: if your plan charges a $20 copay for a visit to your primary care doctor, it can’t charge you $40 for a therapy session. If there are no annual limits on your physical therapy visits, there generally shouldn’t be limits on your mental health therapy sessions. Your plan can’t create more barriers to mental health care than it does for medical care.

What happens when your insurance company says no? Despite these protections, denials still happen. If your claim is denied, you have rights and a clear path to appeal.

Start by understanding why your claim was denied. Your insurer must provide a written explanation. The reason is often a simple paperwork issue, like a coding error or missing documentation.

Next, gather your evidence. Collect your plan documents (SBC and EOC), the denial letter, and any notes from phone calls with your insurer. Ask your provider for a letter explaining why the service was medically necessary.

File an internal appeal with your insurance company. Explain why the decision was wrong. Many denials are overturned at this stage with strong provider documentation.

If that doesn’t work, you can request an external review. An independent third party will review your case, and their decision is binding on your insurance company. For detailed guidance, the guide to the federal parity law provides comprehensive information.

How to read mental health insurance benefits to find a covered therapist

Finding an in-network mental health professional can be challenging. Here’s how to make the process smoother.

Start with your insurer’s provider directory, but manage your expectations. These online directories are notorious for being outdated—what advocates call “ghost networks.” You may find that listed providers aren’t accepting new patients, have moved, or are no longer in-network.

The phone number on your insurance card is often more reliable. Call the dedicated behavioral health line and ask for current in-network providers in your area. Representatives can provide real-time information and verify coverage.

Let the professionals help you. Many mental health providers, including intensive programs like those at Thrive Mental Health, will verify your benefits for you. As a Florida-based provider, we can contact your insurance company directly to determine your coverage, deductible, and copay.

Don’t worry about pre-existing conditions. Thanks to the Affordable Care Act, insurance companies can’t deny you coverage or charge you more because of a mental health condition you had before getting insurance.

When you’re looking for intensive outpatient or partial hospitalization programs, the process is similar but often requires additional verification. Programs like Thrive’s work with various insurance providers, including Cigna, Optum, and Florida Blue, but each plan has different requirements for these higher levels of care.

Persistence and documentation are key to navigating insurance. Keep records of all communication and advocate for yourself. Your mental health is worth the effort. For more comprehensive information about working with different insurance providers, check out our guide on insurance companies.

Frequently Asked Questions about Mental Health Insurance

How do I read my mental health insurance benefits in 4 steps?

- Find your SBC/EOC and member portal.

- Confirm costs: deductible, copay, coinsurance, out-of-pocket max.

- Check in-network providers and referral/prior auth rules.

- After visits, read your EOB: allowed amount, plan payment, what you owe.

What should I ask my insurer before booking therapy?

- Is the provider in-network? What’s my copay/coinsurance after deductible?

- Do I need a referral or prior authorization?

- Is teletherapy covered the same as in-person? Any session limits?

Is teletherapy covered in Florida?

Yes, most plans in Florida cover teletherapy at parity with in-person visits. Always confirm your specific plan’s policy and network. If you’re unsure, we can verify your insurance for you.

Will Cigna, Optum, or Florida Blue cover IOP/PHP?

Often yes, if medically necessary and in-network. Coverage varies by plan. Check benefits for IOP and PHP, and ask about preauthorization requirements.

How do I confirm a therapist is in-network?

Use your member portal, call the behavioral health number on your card, and confirm with the provider’s office. Keep notes (date, rep name, reference number).

Suggested FAQPage JSON-LD (add to page HTML):

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How do I read my mental health insurance benefits in 4 steps?”,

“acceptedAnswer”: {“@type”: “Answer”, “text”: “Find your SBC/EOC and portal; confirm deductible/copay/coinsurance/OOP max; check network and prior auth; read your EOB for allowed amount, plan pay, and your cost.”}

},

{

“@type”: “Question”,

“name”: “What should I ask my insurer before booking therapy?”,

“acceptedAnswer”: {“@type”: “Answer”, “text”: “Ask about in-network status, copay/coinsurance after deductible, referral/prior auth, teletherapy coverage, and any session limits.”}

},

{

“@type”: “Question”,

“name”: “Is teletherapy covered in Florida?”,

“acceptedAnswer”: {“@type”: “Answer”, “text”: “Yes, most plans in Florida cover teletherapy at parity with in-person visits. Always confirm your specific plan’s policy and network. If you’re unsure, we can verify your insurance for you.”}

},

{

“@type”: “Question”,

“name”: “Will Cigna, Optum, or Florida Blue cover IOP/PHP?”,

“acceptedAnswer”: {“@type”: “Answer”, “text”: “Often yes when medically necessary and in-network; coverage varies by plan and may require preauthorization.”}

},

{

“@type”: “Question”,

“name”: “How do I confirm a therapist is in-network?”,

“acceptedAnswer”: {“@type”: “Answer”, “text”: “Check your member portal and call the behavioral health line; confirm with the provider and document the call.”}

}

]

}

Get the Support You Deserve

Learning how to read mental health insurance benefits is about breaking down barriers to care. When you understand your coverage, you stop guessing and start accessing the support you deserve.

Navigating insurance while dealing with mental health challenges is overwhelming, and that’s normal. But know this: you have the right to mental health treatment. The Mental Health Parity Act ensures your mental health coverage can’t be treated as less important than your physical health coverage.

Understanding your benefits is the first step. Many people find they have better coverage than they thought.

At Thrive Mental Health, we see how transformative it can be when someone finally gets the support they need. We help Floridians use their benefits for our flexible Intensive Outpatient (IOP) and Partial Hospitalization (PHP) programs. Our evidence-based programs, available virtually or in-person across Florida, are designed to fit your life.

With evening options, you don’t have to choose between your health and your responsibilities. We work with your insurance to make sure cost isn’t a barrier.

Ready for support? Thrive offers virtual and hybrid IOP/PHP with evening options. Verify your insurance in 2 minutes (no obligation) → Start benefits check or call 561-203-6085. If you’re in crisis, call/text 988.