Insure Your Peace of Mind with These Trusted Insurance Companies

Why Understanding Insurance Companies is Essential for Your Financial Security

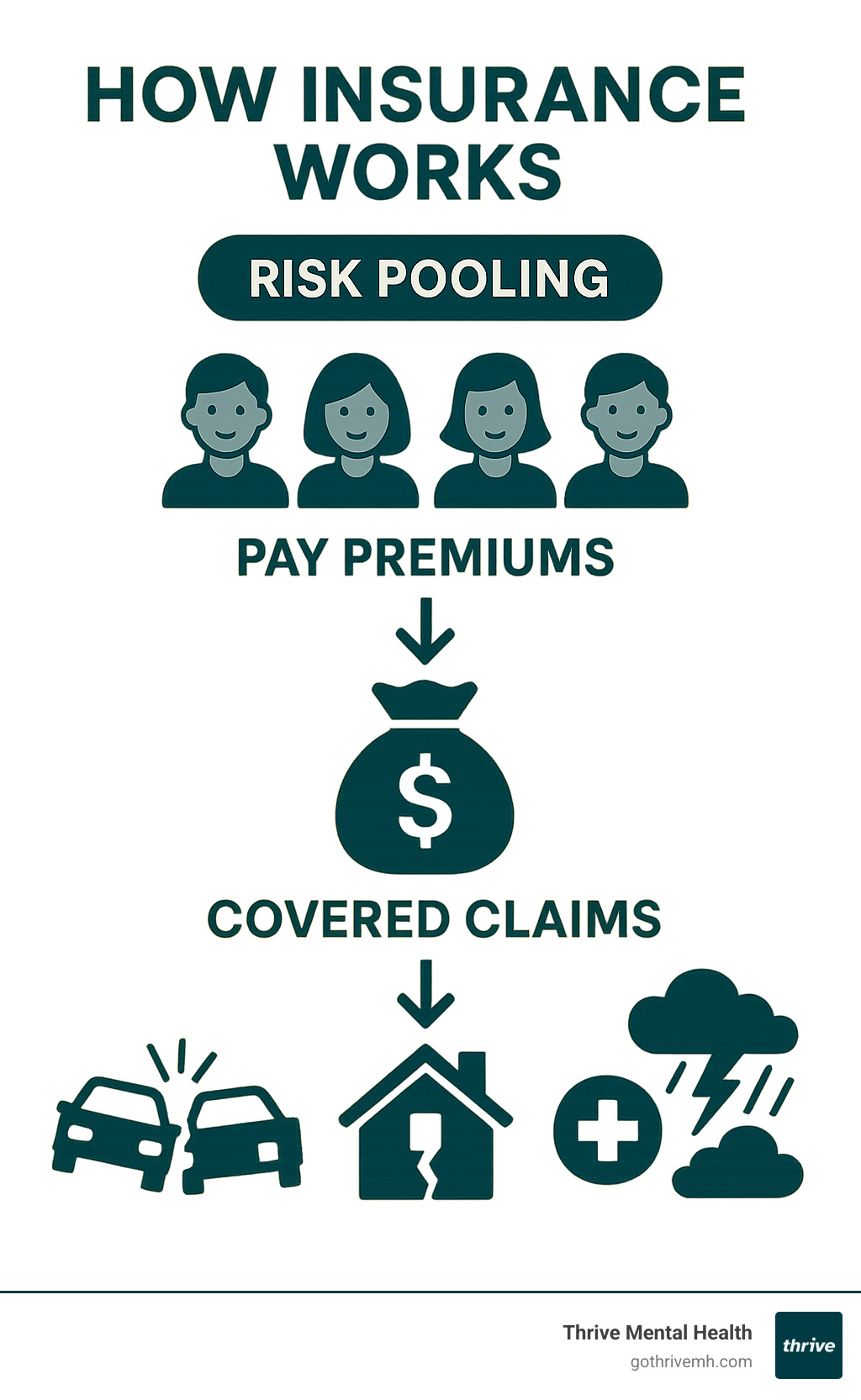

Insurance companies provide the financial safety net that protects you and your family from life’s unexpected events. When disaster strikes—a car accident, home damage, or a health emergency—these companies cover costs that could otherwise devastate your finances. The industry is built on a simple principle: pooling risk across many people to make coverage affordable. You pay a relatively small premium, and in return, the insurance company promises to help cover major expenses if something goes wrong.

For busy professionals in Florida, choosing the right insurance is about protecting your financial future while you focus on your career. Auto insurance is mandatory in most states, and lenders require home insurance for a mortgage. But navigating the dozens of providers can feel overwhelming.

Some top insurance companies include:

- United Health Group: Largest by revenue.

- Progressive: A leading motorcycle insurer since 1937.

- Allstate: Offers insurance estimates in minutes.

- GeoVera: Holds an “A” (Excellent) A.M. Best rating for catastrophe coverage.

As Nate Raine, CEO of Thrive Mental Health, I’ve worked extensively with insurance companies through my healthcare leadership roles. My experience has shown me how the right insurance partnership can make quality care accessible and affordable, especially for behavioral health services.

Understanding the World of Insurance

Think of insurance as a financial umbrella for life’s storms. Insurance companies turn major financial risks into manageable monthly payments, giving you peace of mind. We all face risks daily, from driving in Tampa to dealing with Florida’s hurricane season. Insurance spreads these risks across thousands of people so no one person bears the full burden alone.

Some insurance is required by law. Auto insurance is mandatory in Florida, and if you buy a home in St. Petersburg, your mortgage lender will require homeowners insurance. These policies protect both their investment and yours. The insurance landscape is vast, with hundreds of companies offering different types of coverage. You can explore the full scope by checking out resources like the List of United States insurance companies – Wikipedia.

Common Types of Insurance Policies

- Auto insurance: Covers damage to your car, property damage you may cause, and injuries from accidents. Progressive is a well-known leader in motorcycle insurance.

- Home insurance: Protects your house and belongings from fire, theft, and storms. It also includes liability coverage if someone is hurt on your property. Condo and renters policies cover specific needs.

- Health insurance: Helps cover medical care, prescriptions, and mental health services.

- Life insurance: Provides a death benefit to your beneficiaries to help them cover expenses.

- Business insurance: Protects entrepreneurs from property damage, liability claims, and business interruptions.

How the Insurance Industry is Regulated

Insurance companies are heavily regulated at the state level to protect consumers. In Florida, the Florida Office of Insurance Regulation ensures insurers are financially stable enough to pay claims. They review policies and rates, investigate complaints, and require companies and agents to be properly licensed. This system provides confidence that your insurer will be there when you need them. Regulators maintain lists of licensed insurers so you can verify a company is authorized to do business in your state.

Major Players in the Insurance Market

The insurance world includes massive global corporations and smaller specialized providers. The biggest insurance companies often extend into financial services and healthcare.

United Health Group is a leader in health insurance, while Berkshire Hathaway owns well-known insurers like GEICO. CVS Health has evolved into a major health benefits provider, and The Cigna Group also focuses on health insurance. These giants provide the backbone of the global insurance industry, but bigger doesn’t always mean better for your specific needs. The key is finding an insurance company that offers the right coverage, service, and value for you.

How to Choose From the Best Insurance Companies

Finding the right insurance companies is easier when you break it down. Start by gathering multiple quotes, as rates can vary significantly for identical coverage. Companies like Allstate provide estimates in minutes. Once you have quotes, dig deeper than the price. Read customer reviews, paying special attention to the claims process.

It’s also wise to check financial strength ratings from agencies like A.M. Best. When GeoVera displays their “A” (Excellent) rating, it signals they have the financial stability to pay claims. This helps you avoid companies that might struggle to honor their promises.

Key Factors When Comparing Insurance Companies

When weighing your options, several factors are critical:

- Coverage options: Ensure the company offers what you need. Bundling auto, home, and life insurance can simplify management and often leads to significant discounts.

- Customer service reputation: This is crucial when something goes wrong. Look for responsiveness; for example, Intact Insurance is known for answering claim calls within 20 seconds.

- Claims process efficiency: You need a company that moves quickly during an emergency. Look for insurers that emphasize swift processing and clear communication.

- Available discounts: Safe driving programs, low-mileage discounts, and bundling can save you hundreds annually.

- Digital tools and apps: Modern insurers offer apps for everything from getting quotes to filing claims and accessing digital proof of insurance. This convenience is becoming standard.

You can get a quote from many providers online to begin your comparison.

Understanding How Insurance Companies Calculate Premiums

Premiums are calculated using a complex recipe of factors:

- Risk assessment: For auto insurance, this includes your driving record, age, and car type.

- Location: Living in hurricane-prone areas of Florida means higher home insurance premiums. High-traffic areas in Miami or Orlando increase auto insurance risk and cost.

- Coverage amount: Higher liability limits or comprehensive coverage cost more but offer better protection.

- Deductible level: A higher deductible lowers your premium, but you pay more out-of-pocket for a claim. A lower deductible does the opposite. Choose based on your financial comfort.

- Bundling policies: Insuring your car, home, and more with one company usually open ups significant savings.

- Usage-based discounts: These programs track your actual driving behavior, rewarding safe habits and low mileage with lower rates.

Navigating Claims and Customer Service

When you need to use your insurance, the true test of any insurance company is its claims process. This is when your premiums transform into financial protection.

The process is straightforward. First, report the incident as soon as it’s safe, using the company’s 24/7 hotline, mobile app, or online portal. Next, provide all the details. An adjuster will be assigned to investigate your case, determine what’s covered, and estimate costs. Documentation is key—take photos, save reports, and keep receipts. Finally, once approved, the insurance company will issue payment for covered losses, either to you or directly to service providers.

How the Best Insurance Companies Leverage Technology

The digital revolution has transformed how we interact with insurance companies. Mobile apps and online portals like Allstate’s myAllstate platform put your insurance world at your fingertips. You can view policies, make payments, and download documents 24/7.

Digital proof of insurance is a major convenience, especially in Florida. Instead of searching your glove compartment, you can show your insurance card on your phone. Many insurance companies are also using AI to speed up claims processing, which means faster payouts for you.

What to Expect from Top-Rated Insurance Companies

Choosing a top-rated insurance company means investing in a partnership. You should expect:

- Round-the-clock support: Reliable companies ensure someone is always available to help, whether it’s a midnight accident or weekend water damage.

- Speed and communication: Look for companies that process claims quickly and keep you informed throughout the journey.

- Dedicated local agents: Many companies maintain strong agent networks for those who prefer face-to-face guidance. You can often Find an agent on their websites.

- Proactive communication: The best companies send updates about severe weather, share safety tips, and alert you to new discounts, showing they are invested in your well-being.

A Deep Dive into Mental Health Insurance Coverage

As someone who’s spent years helping people steer mental health care, I know that understanding how insurance companies handle this coverage is crucial. At Thrive Mental Health, we see how the right insurance can be the difference between getting necessary care and going without support.

The good news is that mental health services are an essential health benefit. The Affordable Care Act requires most health plans to cover mental health and substance use disorder services. Building on this, the Mental Health Parity and Addiction Equity Act requires that mental health coverage be as generous as medical coverage. This means your copay for a therapist should be similar to that for another specialist.

Despite these protections, navigating benefits can be complex. That’s why we’ve created resources like our guide on Navigating Mental Health Support with Aetna and UnitedHealthcare to help.

The Challenge of In-Network vs. Out-of-Network Care

Even with parity laws, finding in-network mental health care can be a frustrating maze. While most primary care doctors are in-network, far fewer mental health providers are. The reason often comes down to money: insurance companies typically reimburse mental health providers at lower rates than physical health providers.

This payment gap pushes many talented therapists and psychiatrists to work outside insurance networks. As a result, patients are far more likely to seek out-of-network mental health care compared to medical care. A recent study confirms this disparity, showing patients go out-of-network for psychology and psychiatry services at much higher rates. This creates a significant financial burden. While data shows a therapy session might cost $100-$200 out-of-pocket, insurance can lower it to $20-$50—if you can find an in-network provider.

What to Look for in a Plan for Mental Health Support

Knowing what to prioritize when choosing insurance can save you money and frustration:

- Coverage for therapy: Ensure your plan covers individual, group, and family therapy, including telehealth for flexible scheduling.

- IOP and PHP coverage: This is vital for more serious challenges. Intensive Outpatient and Partial Hospitalization Programs offer structured care. Many of our virtual programs at Thrive Mental Health are covered; learn more on our Virtual IOP Insurance page.

- Prescription coverage: Check the plan’s formulary to see which mental health medications are covered and at what cost.

- Low copays and deductibles: High out-of-pocket costs can be a barrier to consistent care.

The most important step is to always verify your benefits with your insurance company. We’ve created resources like Exploring Mental Health Resources with Cigna and UnitedHealthcare to help you steer these conversations.

Frequently Asked Questions about Insurance

Navigating insurance companies can bring up many questions. Here are answers to some of the most common ones we hear from our Florida community.

How do I know which insurance policy is right for me?

Finding the right policy requires a three-step approach. First, assess what you need to protect—your car, home, health, or family’s future. A Florida resident might prioritize hurricane coverage, while a Tampa renter might focus on renters and health insurance. Second, determine what you can realistically afford. Finally, compare quotes from multiple insurance companies. Look beyond the price to the coverage details and exclusions to ensure you’re getting the best value and protection for your needs.

What is a deductible and how does it work?

A deductible is the amount you pay out-of-pocket before your insurance company begins to pay. For example, with a $1,000 deductible, if you have a $3,000 covered claim, you pay the first $1,000, and your insurer covers the remaining $2,000. There’s a trade-off: a higher deductible usually means a lower monthly premium, while a lower deductible means higher premiums. Choose the level that best fits your emergency fund and financial comfort.

Can an insurance company deny my claim?

Yes, insurance companies can deny claims, but usually for specific reasons. The most common reason is a policy exclusion, meaning the event isn’t covered by your policy (e.g., standard home insurance often excludes floods). Other reasons include not having the right coverage in effect, suspected fraud, or insufficient documentation. If your claim is denied, you have the right to dispute the decision through an appeals process. You can also contact Florida’s Office of Insurance Regulation for assistance to ensure you’re being treated fairly.

Conclusion

Understanding insurance companies is about building a fortress against life’s unexpected storms. By now, you have a roadmap for making smart choices: get multiple quotes, compare coverage, check financial ratings, and understand how premiums are calculated. These are your tools for finding the right balance between protection and affordability.

For those of us in Florida, proper coverage for our homes, cars, and health is essential. This includes robust mental health benefits. Navigating this part of insurance can be complicated, despite laws like the Affordable Care Act and the Mental Health Parity and Addiction Equity Act. That’s why we created resources like our guide on Blue Cross Blue Shield and Aetna: What You Should Know About Mental Health Benefits.

At Thrive Mental Health, we see how the right insurance partnership makes treatment accessible. We work hard to accept various insurance plans to help our clients get the care they need, such as intensive outpatient or partial hospitalization programs.

The bottom line is that when you choose the right insurance companies, you’re investing in peace of mind. This allows you to focus on your career, relationships, and mental health without the constant worry of financial catastrophe. Take your time, ask questions, and choose the policy that fits your unique life.