A Comprehensive Guide to Mental Health IOP Coverage Benefits

What are the benefits of health insurance covering mental health services like IOP? 2025: Vital

Why Understanding Insurance Coverage Can Save You Thousands on Mental Health Care

If you are in crisis, call or text 988 or chat 988lifeline.org. Call 911 if you’re in immediate medical crisis.

What are the benefits of health insurance covering mental health services like IOP? The short answer: it makes recovery affordable. Health insurance transforms mental health care from a luxury into an accessible right, especially for services like Intensive Outpatient Programs (IOP) that deliver faster, more structured results than weekly therapy.

Before recent reforms, 72% of adults with mental illness avoided treatment due to cost. Today, federal parity laws mandate equal coverage for mental and physical health, you can’t be denied for pre-existing conditions, and there are no lifetime benefit limits. This means therapy sessions can drop from $100-$200 to a $20-$50 copay, and intensive programs are now within reach.

Many people don’t realize that programs like IOP—which offer 9+ hours of weekly therapy while you maintain your job and daily life—are now covered by most plans, including Medicare as of 2024. This guide cuts through the confusion to show you exactly how to use your insurance to access the care you need without breaking the bank.

I’m Nate Raine, CEO of Thrive Mental Health. I’ve seen how understanding what are the benefits of health insurance covering mental health services like IOP removes the single biggest barrier to recovery. Let’s get you the help you deserve.

Know your What are the benefits of health insurance covering mental health services like IOP? terms:

- do insurance plans have to offer mental health benefits

- how to read mental health insurance benefits

- medical insurance cover therapy

The Financial Lifeline: How Insurance Slashes the Cost of IOP and Mental Health Care

Without insurance, mental health care costs can be staggering. A single therapy session runs $100 to $200. An Intensive Outpatient Program (IOP) can cost several thousand dollars a month. It’s no wonder 72% of adults with mental illness once avoided care due to the price tag.

What are the benefits of health insurance covering mental health services like IOP? The most immediate benefit is cost reduction. Insurance turns those $100-$200 sessions into manageable copayments (a fixed fee, often $20-$50). After you meet your annual deductible (the amount you pay before your plan pays more), you’ll only owe coinsurance (a percentage of the cost, like 20%).

The ultimate safety net is your out-of-pocket maximum. This is the absolute most you will pay for covered services in a year. Once you hit this cap, your insurance pays 100%. This protection is critical for intensive treatments like IOP, as it prevents catastrophic expenses no matter how much care you need.

Want to understand your specific plan? Our guide on How to Read Mental Health Insurance Benefits can help, and we’ve also compiled information on finding Affordable Health Plans.

Understanding the True Financial Benefits of Health Insurance for Mental Health

The savings go beyond copays. Insurance provides a complete financial safety system for your mental health. Reduced direct costs and predictable spending mean you can afford consistent care without the anxiety of surprise bills. This consistency is what makes treatment effective.

More importantly, insurance offers financial protection from crisis care. By covering preventive services like IOP, it helps you manage issues before they escalate into costly ER visits or hospitalizations. The long-term benefits are also significant: effective mental health treatment improves focus at work, reduces sick days, and can even lower your overall healthcare spending by improving related physical health conditions.

Your Rights Explained: Parity Laws That Mandate Mental Health Coverage

For decades, insurance companies treated mental health as less important than physical health. Federal law has changed that, giving you powerful legal protections. Understanding what are the benefits of health insurance covering mental health services like IOP is understanding your rights.

The Mental Health Parity and Addiction Equity Act (MHPAEA) of 2008 established that insurers must cover mental health and substance use disorders the same way they cover medical and surgical benefits. This means your deductibles, copays, and out-of-pocket maximums can’t be more restrictive for mental health care.

The Affordable Care Act (ACA) strengthened these protections by:

- Making mental health and substance use disorder services one of the ten Essential Health Benefits that most plans must cover.

- Banning denials for pre-existing conditions. You cannot be charged more or denied coverage for a diagnosed condition like depression or anxiety.

- Eliminating lifetime and annual dollar limits on essential health benefits, including mental health care.

Some states, including Florida, offer even stronger protections that build on federal law, mandating timely access to appointments. These laws are enforceable rights that empower you to seek care without fear of discrimination. Learn more about what the law says about mental health coverage and whether Do Insurance Plans Have to Offer Mental Health Benefits?.

What are the benefits of health insurance covering mental health services like IOP under these laws?

Parity laws make IOP an accessible, covered benefit. Here’s what that means for you:

- Equal Treatment: Your IOP coverage must be comparable to how your plan covers intensive medical programs, like cardiac rehab. Insurers can’t create a separate, stricter set of rules for mental health.

- Fair Financials: Your copays and deductibles for IOP should be similar to those for other specialist medical care. All your mental and physical health costs count toward the same out-of-pocket maximum.

- Reasonable Limits: Insurers can require treatment to be “medically necessary,” but they can’t impose arbitrary session caps on IOP that don’t exist for comparable medical treatments.

- Fair Processes: Non-quantitative treatment limitations (NQTLs), like prior authorization requirements, must be applied no more stringently to mental health than to physical health. This prevents hidden barriers to care.

What are the benefits of health insurance covering mental health services like IOP? [A Deep Dive]

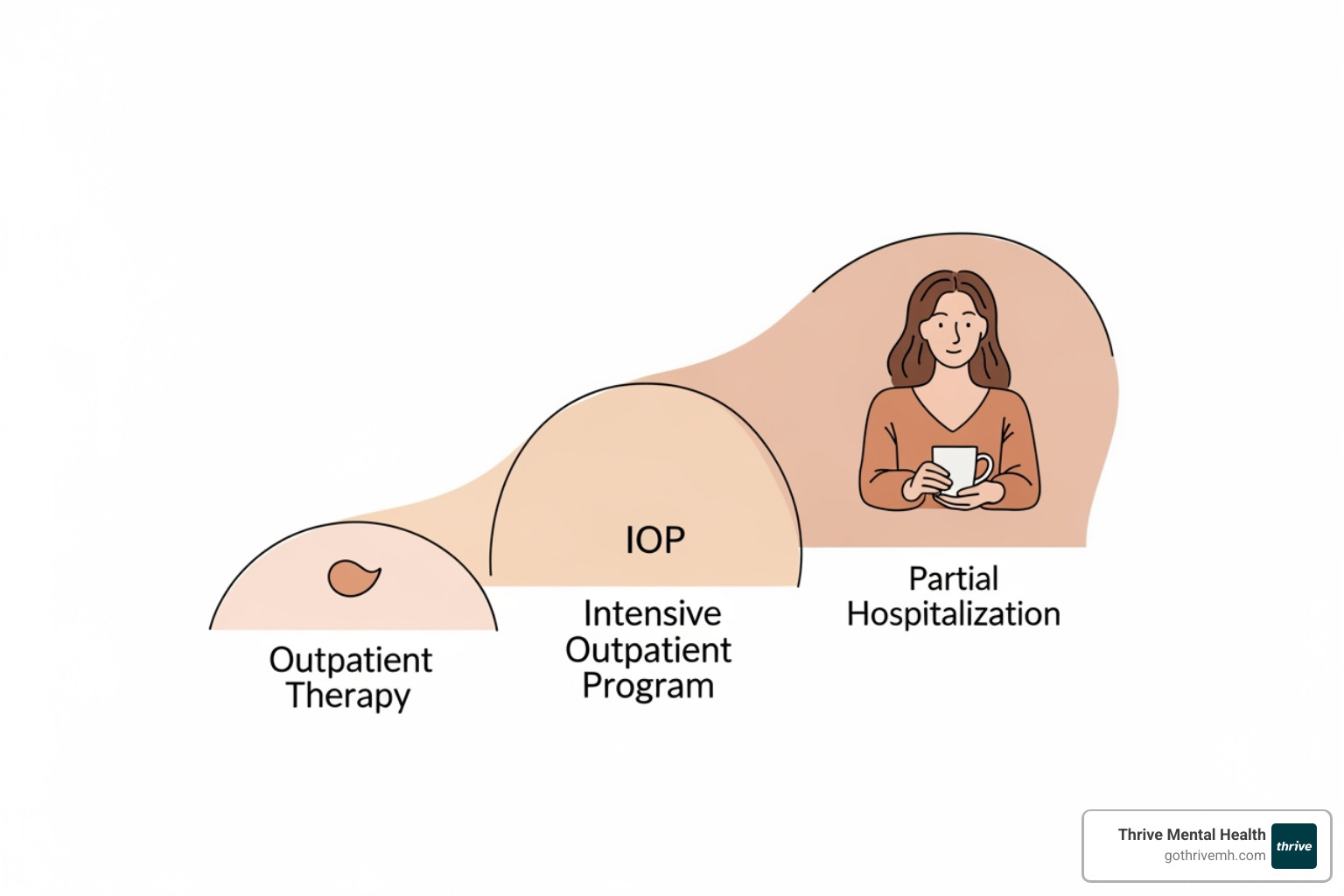

Think of mental health care on a spectrum. On one end is weekly therapy; on the other is 24/7 inpatient care. Intensive Outpatient Programs (IOP) fill the critical gap in between.

What is an IOP? An IOP provides 9 to 19 hours of structured therapy per week, allowing you to get intensive support while maintaining your job, school, and home life. At Thrive Mental Health, our Florida-based programs are designed to fit your schedule.

Who needs IOP? This level of care is ideal if:

- Weekly therapy isn’t providing enough support.

- You’re dealing with moderate to severe depression, anxiety, trauma, or substance use challenges.

- You’re transitioning from inpatient care and need a step-down program to maintain progress.

IOP combines group therapy, individual therapy, and medication management in a structured schedule. The key benefit is practicing coping skills in your real-world environment and getting immediate feedback, which accelerates healing far more than weekly sessions can. This is why understanding what are the benefits of health insurance covering mental health services like IOP is so crucial—it makes these highly effective programs affordable. Learn more about What’s an IOP? and explore our Virtual IOP Program.

How Insurance for Virtual IOP (VIOP) is Revolutionizing Access

Virtual Intensive Outpatient Programs (VIOP) have become a primary way people access high-quality treatment. Most private insurance plans now cover VIOP just as they would an in-person program, opening doors for thousands.

VIOP eliminates barriers. If you’re in a remote part of the Panhandle or have a demanding job in Miami, virtual care brings treatment to you. The flexibility helps you maintain your daily life, and the privacy of home can make it easier to open up. At Thrive, we’ve found that consistency matters more than location. Virtual platforms ensure you never miss a session due to traffic or other obstacles, leading to better outcomes.

Our virtual programs across Florida deliver the same evidence-based results as in-person care, with the added benefit of convenience. One key exception: Medicare currently only covers in-person IOP. Read more on The Benefits of a Virtual Intensive Outpatient Program (VIOP).

Navigating Your Plan: A Practical Guide to Accessing IOP Care [2025]

Knowing your benefits is one thing; using them is another. Here’s a practical guide to accessing IOP care in Florida.

-

Find In-Network Providers: Start by searching the online provider directory for your insurance company (e.g., Florida Blue, Aetna, Cigna, UnitedHealthcare). Look for “Intensive Outpatient Program” or “behavioral health.” You can also ask your primary care physician for a referral.

-

Verify Your Benefits: Call the provider’s office to confirm they accept your specific plan. Ask about your copay, deductible, and coinsurance for IOP services. At Thrive Mental Health, we can verify your benefits for you in minutes.

-

Handle Prior Authorization: Most intensive programs require prior authorization, meaning your insurer must approve the treatment beforehand. This is a standard process to confirm medical necessity. Your IOP provider should manage this entire process for you.

For more details on specific plans, explore our guides to the Insurance Companies we work with and our Comprehensive Guide to Aetna, Florida Blue, and Evernorth Plans.

What to Do If Your IOP Insurance Claim is Denied

A denial is frustrating, but it’s not the final word. You have the right to appeal.

-

Review Your Explanation of Benefits (EOB): This document will state the reason for the denial (e.g., “not medically necessary,” coding error).

-

Contact Your Insurer: Call the member services number to understand the denial and the steps to appeal. Document who you spoke to and when.

-

File an Internal Appeal: Submit a written request to your insurer to reconsider the claim. Your IOP provider is your strongest ally here and can supply a letter of medical necessity and other supporting documents. The NAMI appeals guide offers step-by-step instructions.

-

Request an External Review: If the internal appeal is denied, you can have an independent third party review your case. This is where parity laws are especially powerful.

State consumer assistance programs and the Department of Labor’s hotline can also provide support. At Thrive, we help clients steer this process to get the coverage they’re entitled to.

IOP Coverage Across Different Plans [Medicare vs. Medicaid vs. Private Insurance]

How your insurance covers IOP depends on your plan type. Understanding these differences is key to avoiding unexpected bills.

| Feature | Private Insurance (e.g., Florida Blue, Aetna, Cigna, UnitedHealthcare) | Medicare Part B | Medicaid (varies by state) |

|---|---|---|---|

| Virtual Coverage | Generally covers virtual IOP (VIOP) | Currently covers in-person IOP only | Generally covers virtual IOP (VIOP) |

| Typical Cost-Sharing | Copays, deductibles, coinsurance (varies by plan) | 20% coinsurance after deductible (no copay for depression screening) | Often low or no copays/deductibles (varies by state) |

| Provider Network | Large networks of contracted providers | Specific certified facilities (hospitals, CMHCs, FQHCs, RHCs, OTPs) | State-specific networks, often robust for mental health |

| Parity Laws | Fully subject to MHPAEA & ACA parity rules | Subject to specific Medicare rules; MHPAEA does not directly apply to Medicare | Subject to MHPAEA & ACA parity rules as essential benefits |

| Pre-existing Conditions | Covered (no denial or higher cost) | Covered | Covered |

| IOP Specifics | Covers IOPs if deemed medically necessary; prior authorization common | New in 2024; covers IOP services (9+ hrs/week) | Most states cover IOPs; varies by state’s specific benefits |

Private Insurance

Plans from employers or the Marketplace (e.g., Florida Blue, Aetna, Cigna) are subject to full parity laws. They must cover IOP as an essential benefit, and most now cover virtual IOP (VIOP). Expect standard copays and deductibles.

Medicare Part B

As of 2024, Medicare now covers IOP services. However, there’s a major limitation: it covers in-person IOP only. After meeting your deductible, you’ll pay 20% of the approved amount. For more, see our guide to Medicare Mental Health Coverage.

Medicaid

Coverage for IOP varies by state but is generally strong. Florida’s Medicaid programs typically cover virtual IOP (VIOP), expanding access for many. Learn more about Medicaid Covered Therapy.

At Thrive Mental Health, we work with all three insurance types across our Florida locations to help you access the care you deserve.

Frequently Asked Questions about IOP Insurance Coverage

How do I know if my specific insurance plan covers IOP?

The best way is to ask directly. Here are four quick ways to check:

- Read your Summary of Benefits and Coverage (SBC). Look for “mental/behavioral health” or “outpatient services.”

- Call the member services number on your insurance card and ask specifically about “Intensive Outpatient Program” coverage.

- Check your insurer’s online portal. Most major insurers like Florida Blue, Aetna, and Cigna list benefits online.

- Ask the provider. An IOP provider like Thrive Mental Health can verify your benefits for you, often in just a few minutes.

Are there limits on how many IOP sessions my insurance will cover?

Generally, no. Mental health parity laws prevent insurers from imposing arbitrary session caps on mental health care that don’t also apply to medical care. Coverage is based on “medical necessity,” which your provider documents to the insurance company. Prior authorization is a standard step for intensive programs, but the process must be fair and non-discriminatory.

Does insurance cover virtual IOP (VIOP) programs?

Yes, in most cases. Most private insurance plans (including employer-sponsored and Marketplace plans) and most state Medicaid plans cover virtual IOP. This has made intensive care accessible to people throughout Florida, regardless of location.

The major exception is Medicare, which currently covers in-person IOP only. If you are a Medicare beneficiary, you must attend IOP at a physical facility for it to be covered. Always verify your specific plan’s benefits before starting treatment.

Conclusion: Take the Next Step Towards Recovery

Understanding what are the benefits of health insurance covering mental health services like IOP is more than just knowing your policy; it’s about recognizing your right to comprehensive, affordable mental health care. Health insurance is a powerful tool that removes financial barriers, provides legal protections, and ensures access to the intensive, life-changing treatment you may need. Mental health is health, and we are committed to making sure that belief translates into accessible care for everyone.

At Thrive Mental Health, we deliver virtual and in-person Intensive Outpatient (IOP) and Partial Hospitalization (PHP) programs across Florida. Our programs combine clinical expertise, flexible scheduling, and measurable results—designed for people who need more than once-a-week therapy but less than inpatient care. We work diligently with a wide range of insurance providers to ensure our evidence-based treatment is accessible to you.

Ready for support? Thrive offers virtual and hybrid IOP/PHP programs with evening options. Verify your insurance in 2 minutes (no obligation) → Start benefits check or call 561-203-6085. If you’re in crisis, call/text 988.