Senior Life Insurance Simplified: Coverage You Can Count On

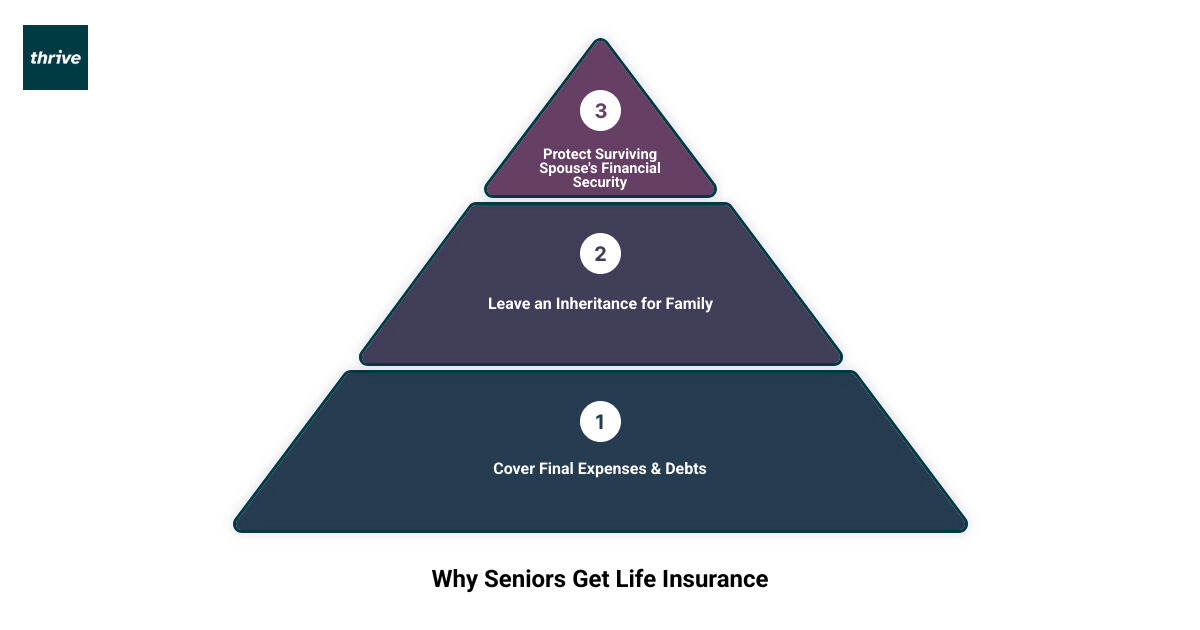

Senior Life Insurance: Top 3 Benefits

Why Senior Life Insurance Matters More Than Ever

Senior life insurance provides financial protection for your loved ones and covers final expenses when you pass away. Here’s what you need to know:

Top 3 Types of Senior Life Insurance:

- Term Life Insurance – Temporary coverage, lower premiums, ideal for specific debts

- Whole Life Insurance – Permanent coverage with cash value, higher premiums

- Guaranteed Issue – No medical exam required, limited coverage amounts

Average Monthly Costs:

- 60-year-old male: $51/month for $100k term, $284/month for $100k whole life

- 70-year-old female: $102/month for $100k term, $430/month for $100k whole life

As we age, financial security is key. Many Florida seniors worry about leaving families with funeral costs or debts. Fortunately, life insurance for seniors over 50, 60, and even 80 is readily available and affordable.

Whether you need to cover final expenses averaging $9,000 to $12,000, protect a spouse’s income, or leave a legacy, the right policy provides peace of mind. Even with health conditions like diabetes or heart disease, options like guaranteed issue policies ensure you can get coverage.

I’m Nate Raine. My work in healthcare strategy here in Florida shows how financial stress impacts mental wellness, especially for seniors. Understanding your senior life insurance options is a crucial step toward financial security and emotional well-being.

Simple senior life insurance word guide:

Why Seniors Need Life Insurance: Securing Your Legacy and Peace of Mind

Senior life insurance isn’t about death; it’s about love, protection, and caring for your loved ones. Whether you’re retired in Florida or elsewhere, financial worries can affect your well-being. The right plan can lift that burden, helping you sleep better at night.

Covering Final Expenses and Outstanding Debts

The average funeral costs between $9,000 to $12,000, a sum your family would have to find during a difficult time. Final expense insurance (or burial insurance) is a small policy designed to cover these costs, plus any final medical bills. It’s a final gift, allowing your family to focus on grieving, not finances.

Beyond funeral costs, senior life insurance can cover outstanding credit card debt, medical bills, or a mortgage balance. This prevents your loved ones from inheriting your financial obligations.

Knowing your family won’t have to sell assets or drain savings to cover your final expenses provides priceless peace of mind.

Protecting Your Spouse and Preserving Assets

If you’re married, you likely worry about your spouse’s financial security. How will they manage when your pension stops or on Social Security alone? Senior life insurance can bridge that gap, helping your surviving spouse maintain their lifestyle.

Your policy can also protect legacy assets like the family home or investments. Life insurance proceeds can cover estate costs and taxes so these treasures don’t have to be sold. For those with multiple children, life insurance can also help equalize inheritances fairly without forcing difficult decisions during an emotional time.

Estate Planning and Leaving a Lasting Gift

A key benefit of life insurance is that the death benefit is typically tax-free for beneficiaries. This means your premium payments can become a much larger gift for your loved ones.

This makes senior life insurance useful for estate planning. It can cover potential estate taxes or allow you to leave a substantial gift to a charity without touching other assets. Many grandparents use life insurance to create educational funds for grandchildren, giving them a financial head start.

The ability to leave a lasting legacy for family or charitable causes gives your policy meaning beyond just financial protection.

For more detailed guidance on choosing the right policy for your situation, check out A Guide to Buying Life Insurance for Seniors.

Types of Senior Life Insurance: Finding the Right Fit

When exploring senior life insurance, you’ll find several options, each fitting different needs and budgets. The key is deciding what matters most: affordable premiums, lifelong coverage, or quick approval without medical hassles. Let’s review the three main types to find your match.

Term Life Insurance: Affordable, Temporary Coverage

Term life insurance provides coverage for a specific period, like 10 or 20 years. It’s the most budget-friendly option, making it ideal for seniors who need to cover a mortgage or provide temporary income support for a spouse.

The catch is that term policies expire. Most end by age 85, and new policies are hard to find after 80. If you outlive the term, the coverage ends with no payout.

However, many term policies offer conversion options, letting you switch to permanent coverage later without a new medical exam. This flexibility allows you to lock in your insurability while keeping future options open.

Whole Life Insurance: Lifelong Protection with Cash Value

Whole life insurance is permanent; as long as you pay your premiums, the coverage lasts for life. Premiums are fixed and never increase, which helps with budgeting on a fixed income.

Whole life includes a cash value component. Part of your premium goes into a tax-deferred savings account that grows over time. You can borrow against or withdraw this money, creating a financial safety net. Many final expense policies are small whole life policies designed to cover funeral costs. While it costs more than term, you get lifelong protection and cash value.

Guaranteed & Simplified Issue: No-Exam Options for Senior Life Insurance

For those who want to avoid a medical exam, no-exam life insurance is an excellent solution.

Guaranteed issue policies guarantee acceptance with no medical exam or health questions. They are a great option if you have serious health issues. The trade-off is a two-year waiting period (a graded death benefit). If you die from illness in the first two years, beneficiaries usually receive returned premiums plus interest, not the full death benefit (accidents are often covered immediately). Coverage is modest, typically $5,000 to $15,000, making it ideal for final expenses.

Simplified issue policies are a middle ground. You answer a few health questions but skip the medical exam. Approval is fast, and you can often qualify with manageable conditions like controlled diabetes. Coverage can reach $100,000, offering more flexibility.

Understanding the Costs and Factors of Senior Life Insurance

Understanding what drives senior life insurance premiums helps you find affordable coverage. Insurance companies assess risk using key factors to determine your monthly payment. The underwriting process involves looking at your age, health, and lifestyle to assess risk. Even with health challenges, options are available.

| Age & Gender | $100,000 10-Year Term Life (Monthly) | $100,000 Whole Life (Monthly) | $10,000 Guaranteed Issue (Monthly) |

|---|---|---|---|

| 60-year-old Male | $51 | $284 | $66 |

| 60-year-old Female | $38 | $239 | $53 |

| 70-year-old Male | $148 | $522 | N/A (higher age for $10k GI not available) |

| 70-year-old Female | $102 | $430 | N/A (higher age for $10k GI not available) |

| 80-year-old Male | N/A (term typically limited) | N/A (whole life higher) | $227 |

| 80-year-old Female | N/A (term typically limited) | N/A (whole life higher) | $183 |

Note: These are average monthly rates and can vary significantly by insurer, specific health profile, and location, including here in Florida.

How Age, Health, and Lifestyle Affect Your Premiums

Age is the biggest factor in your premiums; the older you are when you apply, the higher your payments. Gender also plays a role, as women typically live longer and pay less. Your health and lifestyle are also key. Insurers will ask about pre-existing conditions like diabetes or heart disease. While serious issues may lead to higher premiums, guaranteed or simplified issue policies provide a path to coverage.

Smoking status is a major factor, with smokers paying considerably more. Quitting can lead to lower rates after a certain period. Staying active also matters. Research shows regular physical activity is crucial for older adults, which can positively impact your quality of life and potentially your insurance rates.

Typical Costs for Popular Senior Life Insurance Policies

Here’s a breakdown of what you might pay for different senior life insurance policies to help you budget and compare.

Term life insurance is most affordable. A 60-year-old man might pay around $51/month for a $100,000 10-year policy, while a woman of the same age would pay about $38. At 70, those rates rise to $148 and $102, respectively.

Whole life insurance costs more but is permanent. A $100,000 policy for a 60-year-old man could be $284/month, versus $239 for a woman. At 70, this increases to $522 for a man and $430 for a woman.

Final expense or burial insurance offers smaller coverage for immediate needs. A $10,000 no-exam policy might cost a 60-year-old man $66/month and a woman $53/month.

Guaranteed issue policies ensure acceptance but have higher premiums. An 80-year-old man might pay $227/month for $10,000 in coverage, while an 80-year-old woman could pay $183. These are lifelines for those who might otherwise be declined.

Today’s senior life insurance market in Florida has options for every budget. Understanding these cost factors helps you make an informed decision.

How to Choose and Apply for Your Policy

Finding the right senior life insurance policy doesn’t have to be overwhelming. With the right approach, you can find coverage that fits your family’s needs and your budget.

A Step-by-Step Guide to Finding the Right Policy

First, understand why you need senior life insurance. Is it to cover funeral costs up to $12,000, protect the family home from estate taxes, or leave a gift for your grandchildren’s education? A life insurance calculator can help you determine a coverage amount.

Once you have a target amount, shop around. Insurers view risk differently, so rates can vary significantly, especially in a competitive market like Florida. A 70-year-old with well-controlled diabetes might get vastly different quotes for the same policy. Get quotes from multiple providers and compare premiums, policy features, and available riders.

Reading the policy details is crucial. Pay attention to waiting periods, especially with guaranteed issue policies, to prevent surprises. Finally, use the free-look period (typically 10-30 days) to review the policy and return it for a full refund if it’s not the right fit.

Applying with Pre-Existing Health Conditions

If you have health conditions like diabetes or heart disease, you might worry senior life insurance is out of reach. That’s rarely the case; you just need to know how to approach the process.

Be completely honest about your medical history. Hiding information can void your policy when your family needs it most. Many common conditions, like well-controlled diabetes, won’t lead to a denial, though they may result in higher premiums. The key is finding an insurer that works with your health profile.

This is where guaranteed issue and simplified issue policies are invaluable. These no-exam options are designed for those who might not qualify for traditional coverage. They offer lower coverage amounts (often $5,000 to $25,000) but are often sufficient to cover final expenses.

Finding the right insurance provider is key. Some are more understanding of certain health conditions. An independent agent familiar with the Florida market can help you find insurers that are more flexible, saving you time and money.

Frequently Asked Questions about Senior Policies

Here are answers to common questions about senior life insurance to help you secure your family’s financial future.

What are policy riders and which ones are useful for seniors?

Policy riders are optional add-ons to your senior life insurance policy that can add significant value, especially for challenges related to aging.

- The accelerated death benefit rider is vital for seniors. If diagnosed with a terminal illness, it lets you access part of your death benefit while you’re still alive for medical care or other needs.

- A long-term care rider helps pay for expensive nursing home or in-home care services by tapping into your policy’s death benefit.

- The critical illness rider provides a lump sum if you’re diagnosed with a serious condition like a heart attack or stroke, helping cover treatment and daily expenses.

- A waiver of premium rider waives your premiums if you become disabled and can’t work, ensuring your coverage continues.

What is the ‘ladder strategy’ and can seniors use it?

The ladder strategy helps manage coverage needs and budget. You buy several smaller term policies of different lengths, creating a ‘ladder’ that matches your changing financial responsibilities. For example, you might buy a 10-year policy to cover a mortgage and a 15-year policy for spousal income support. As each term ends and a financial obligation is met, your overall premium cost decreases.

This strategy can save money by ensuring you don’t overpay for coverage you no longer need. It’s useful for seniors with specific, time-bound financial goals.

What’s the difference between buying direct vs. through a broker?

This choice is about a DIY approach versus getting guided help to shop for you.

Buying directly from an insurance company is straightforward. If you’ve done your research and know what you want, this can be an efficient route. Some direct providers specialize in senior coverage with simple applications.

Working with an independent broker or agent means having an advocate who compares policies from multiple companies to find the best fit. A broker is especially helpful for Florida residents with complex health or financial situations, as they know which companies are more lenient and can guide you through the application. While some prefer going direct, others value an expert’s guidance.

Conclusion: Financial Security for Your Golden Years

Planning for senior life insurance is a caring act for your family. It creates a safety net, ensuring final expenses are covered, debts won’t be a burden, and your legacy is secure. The peace of mind from having your financial affairs in order is invaluable, freeing you to enjoy your retirement in Florida.

There’s a strong link between financial security and mental well-being. Money worries create stress, but protecting your family’s future lifts that weight, allowing you to accept your golden years with confidence.

Here in Florida, caring for your physical, mental, and financial health is essential for thriving. Managing major life decisions like insurance planning can be stressful, making mental wellness a priority.

At Thrive Mental Health, we know navigating complex financial decisions is stressful. Worrying about insurance, your family’s future, or health challenges can affect your mental well-being. We’re here to support you with flexible, evidence-based care that fits your lifestyle.

If you’re feeling anxious about financial planning or the stress of aging, professional help is available. Caring for your mental health is as important as securing your financial future.

Ready to take the next step? Learn more about managing your health and financial well-being in Florida and find how planning for both mental wellness and financial security can help you thrive.