Insurance & Online Therapy: A Guide to Maximizing Your Benefits

Insurance Covered Online Therapy: 3 Affordable Benefits

Your First Step to Affordable Mental Healthcare

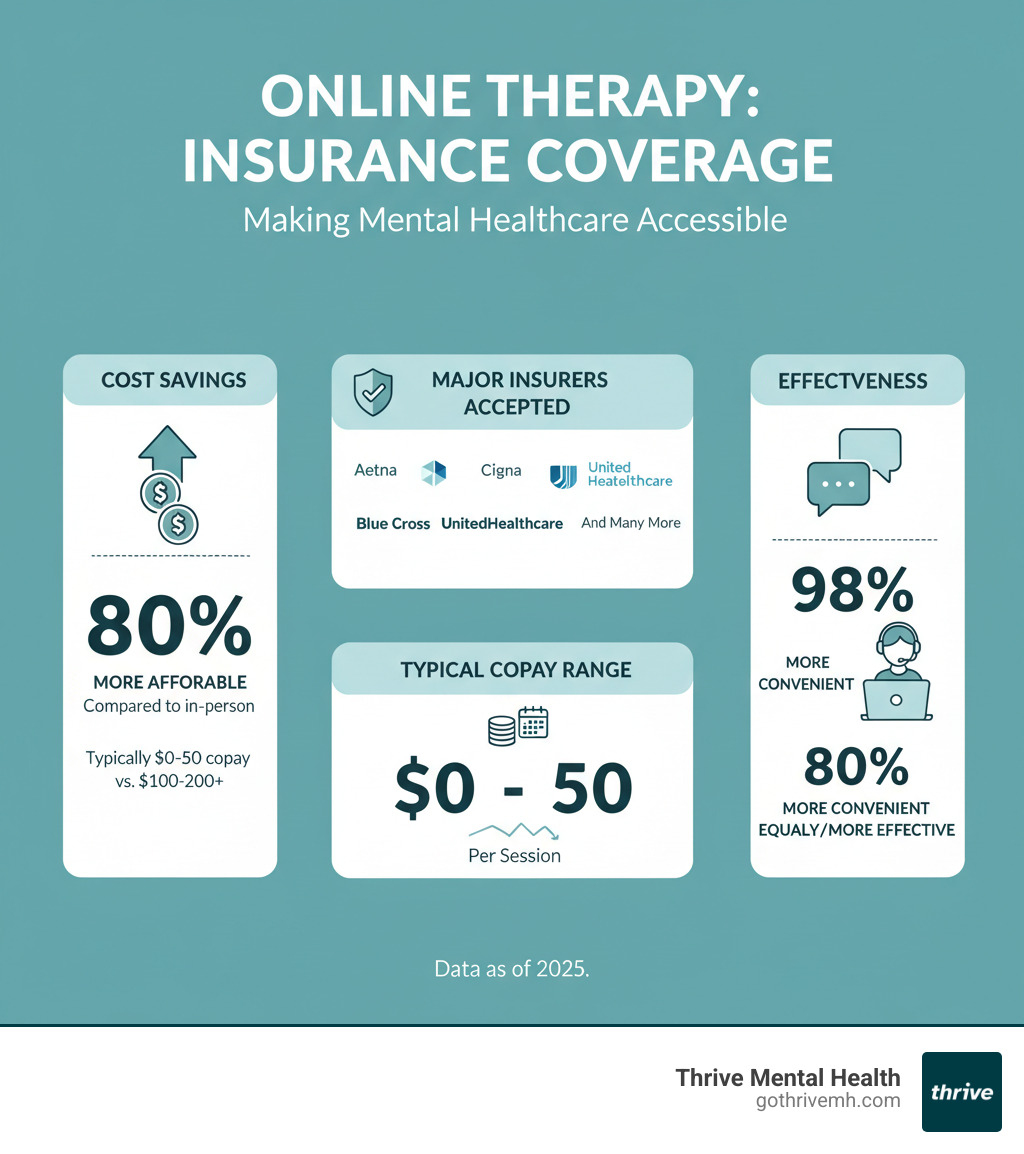

Insurance covered online therapy has revolutionized how people access mental healthcare, making professional support both affordable and convenient for residents across Florida. With the right insurance plan, you can receive quality therapy for as little as $0-$25 per session through secure video calls, phone sessions, or messaging platforms.

Quick Answer: What You Need to Know

- Most major insurers now cover online therapy (Aetna, Cigna, Blue Cross, UnitedHealthcare, etc.)

- Your cost: Typically just a copay of $0-$50 per session

- Coverage includes: Individual therapy, couples counseling, and psychiatric services

- Requirements: Use in-network providers for maximum benefits

- Process: Verify coverage → Get matched with therapist → Start sessions

The shift to telehealth has been dramatic. 98% of users find online therapy more convenient than traditional in-person sessions, while 80% report it’s equally or more effective. Major online therapy platforms now partner with dozens of insurance plans, serving more than 100 million Americans.

Gone are the days of choosing between quality care and your budget. Insurance covered online therapy removes traditional barriers like long wait times, expensive copays, and scheduling conflicts that keep busy professionals from getting help.

I’m Anna Green, LMHC, LPC, Chief Clinical Officer at Thrive Mental Health. My experience in developing accredited virtual behavioral health programs has shown me how insurance covered online therapy makes quality mental healthcare accessible to everyone.

Insurance covered online therapy terms made easy:

What is Online Therapy and How Does It Work?

Insurance covered online therapy connects you with licensed mental health professionals through secure digital platforms, bringing quality care directly to your home, office, or wherever you feel most comfortable. Think of it as having a therapist’s office in your pocket – minus the commute and waiting room anxiety.

The process is refreshingly straightforward. After signing up with a telehealth platform, you’ll be matched with a licensed therapist who fits your needs and takes your insurance. From there, you’ll schedule sessions just like you would for any appointment, except you’re connecting through technology instead of sitting across from each other in person.

What makes this approach so powerful is that the therapeutic relationship remains exactly the same. You’re still working with trained professionals who provide the same evidence-based treatments you’d receive in traditional settings. The only difference? You can attend sessions in your favorite chair, during your lunch break, or even while traveling.

At Thrive Mental Health, we’ve seen how this flexibility transforms people’s ability to prioritize their mental health. Our Virtual Therapy: A Convenient and Effective Approach to Counseling programs are designed with busy professionals in Florida in mind, offering the same intensive care through secure, HIPAA compliant platforms that protect your privacy completely.

The Basics of Virtual Sessions

Your virtual therapy experience can take several forms, depending on your lifestyle and comfort level.

- Video calls are the most popular option, creating a face-to-face connection that helps build trust with your therapist.

- Phone calls offer a great audio-only option, especially if you have internet issues or simply prefer not to be on camera.

- Live chat provides real-time text-based conversations, which can be helpful if you find it easier to write out your thoughts.

- Asynchronous messaging allows you to send text, audio, or video messages to your therapist anytime. They’ll respond within an agreed timeframe (usually 24 hours), offering ongoing support between scheduled sessions.

All these methods use secure platforms designed for healthcare and offer scheduling flexibility, including evening and weekend appointments.

Therapy vs. Psychiatry: What’s Covered?

Understanding the difference between therapy and psychiatry is crucial for maximizing your insurance covered online therapy benefits. Both services play important roles in mental healthcare, but they serve different purposes.

Talk therapy involves working with licensed therapists (like LCSWs, LMFTs, or LPCs) who help you process emotions, develop coping strategies, and work through mental health challenges using evidence-based approaches. These professionals cannot prescribe medication, but they’re experts at helping you understand patterns in your thinking and behavior.

Medication management falls under psychiatry, where medical doctors who specialize in mental health can diagnose conditions and prescribe medications. Psychiatrists focus on the biological aspects of mental health and often work alongside therapists to provide comprehensive care.

Many people benefit from dual coverage – seeing both a therapist and a psychiatrist. For instance, a psychiatrist might manage your anxiety medication while a therapist helps you develop long-term coping skills. Most insurance plans cover both services, though you may need separate providers or find a platform that offers integrated care.

If you’re looking for psychiatric support, particularly with government insurance, exploring options like a Florida Medicaid Covered Psychiatrist can help you access both therapy and medication management affordably.

The beauty of modern telehealth is that you can often access both types of care through the same platform, making coordination between providers seamless and ensuring your treatment plan works as a unified whole.

How Insurance Covered Online Therapy Actually Works

Navigating insurance can sometimes feel like a maze, but understanding a few key terms makes it much simpler, especially when it comes to insurance covered online therapy.

The good news? Most insurance plans work similarly when it comes to online therapy. Your insurance card is essentially your ticket to affordable mental healthcare, but knowing how to use it effectively can save you hundreds of dollars per session.

When you use your insurance for online therapy, the biggest factor affecting your costs is whether your provider is in-network or out-of-network. Think of in-network providers as your insurance company’s preferred partners – they’ve already negotiated rates, which means lower costs for you. Out-of-network providers don’t have these agreements, so you’ll typically pay more upfront and may need to handle reimbursement yourself.

Your copay is the fixed amount you’ll pay for each session after meeting your deductible. For insurance covered online therapy, this can range from $0 to $50, with many people paying around $15-25 per session. Your deductible is the amount you pay out of pocket before your insurance kicks in – once you’ve met it, your copay takes over.

Some providers offer superbills if you choose an out-of-network therapist. These detailed receipts can be submitted to your insurance for potential reimbursement, especially helpful if you have out-of-network benefits. Coinsurance means you’ll pay a percentage of the cost (like 20%) while your insurance covers the rest (80%) after your deductible is met.

For a comprehensive look at how different insurance plans approach mental health coverage, check out our guide on Medical Insurance Cover Therapy.

Understanding Your Out-of-Pocket Costs

Here’s what most people really want to know: What will this actually cost me? With insurance covered online therapy, your wallet will thank you. Many clients end up paying just their copay, which typically falls in the $0-$25 range for in-network providers.

However, there’s a catch if you have a high-deductible plan. Until you meet your annual deductible, you’ll pay the full negotiated rate (still discounted because it’s in-network, but higher than your eventual copay). Once you hit that deductible threshold, your low copay kicks in for the rest of the year.

Meeting your deductible might sound daunting, but all your healthcare expenses count toward it – not just therapy. Your annual physical, lab work, and other medical services all chip away at that number.

Most plans don’t impose session limits anymore, thanks to mental health parity laws. However, some older plans might cap you at 20-26 sessions per year. A quick call to your insurance company can clarify your specific limits.

Pre-authorization is another factor to consider. Some insurance plans require approval before you start therapy, while others let you dive right in. This is especially common for specialized treatments or intensive programs.

Common Services Covered by Insurance

Thanks to mental health parity laws, your insurance plan treats mental health services just like physical health services. This means insurance covered online therapy typically includes a comprehensive range of treatments.

Individual therapy is the most commonly covered service, whether you’re dealing with anxiety, depression, trauma, or life transitions. Couples counseling is increasingly covered by major insurers, recognizing that relationship health impacts overall wellbeing.

Psychiatry services are essential for anyone needing medication management. Online psychiatrists can prescribe most medications and provide ongoing monitoring, all covered under most insurance plans. Anxiety treatment and depression treatment are specifically highlighted in many plans, often with dedicated pathways for faster access.

Many insurers now cover specialized approaches too. We’ve seen excellent coverage for treatments like Dialectical Behavior Therapy (DBT) across different insurance providers. You can learn more about specific coverage differences in our detailed comparison: Understanding Insurance Coverage for Dialectical Behavior Therapy: Blue Cross Blue Shield vs. UnitedHealthcare.

The beauty of modern insurance covered online therapy is that you’re not limited to basic talk therapy anymore. Your plan likely covers evidence-based treatments, group therapy options, and even intensive outpatient programs – all accessible from the comfort of your home.

The Top 3 Benefits of Using Insurance for Online Therapy

Choosing insurance covered online therapy isn’t just about saving money; it’s about opening up a world of accessible, high-quality mental healthcare that fits seamlessly into your life in Florida.

The benefits go beyond the financial, impacting your convenience, access to expert care, and overall well-being. Studies consistently show the effectiveness of online therapy, proving it’s a valuable tool in your healing journey.

1. Drastically Reduce Your Costs

Let’s be honest: traditional therapy can hit your wallet hard. Without insurance, you’re looking at $100 to $200 per session, sometimes more for specialized care. Do the math over a month, and you could be spending $400-$800 just to prioritize your mental health. For many people, this price tag becomes the biggest barrier between them and getting help.

Insurance covered online therapy completely flips this equation. Instead of paying hundreds per session, you’re typically looking at just a copay of $0-$25. That’s it. Your insurance handles the rest.

The savings are genuinely dramatic. Most people using their insurance benefits save around 75% on their therapy costs. What used to be a $150 session becomes a $15 copay. A monthly therapy budget that might have stretched your finances thin suddenly becomes as affordable as a couple of coffee runs.

Here’s what makes this even better: the costs become predictable. No more wondering if you can afford another session this month. No more choosing between therapy and other necessities. With insurance coverage, you know exactly what each session will cost, making it easier to budget for consistent care.

The financial relief goes beyond just the session fees too. You’re not dealing with surprise bills or complex payment arrangements. Your insurance covered online therapy provider handles the billing directly with your insurer, so you can focus on what really matters – your healing journey.

This affordability isn’t just about saving money; it’s about removing the stress and anxiety that comes with expensive healthcare. When cost isn’t a constant worry, you can actually engage more fully in your therapy sessions.

2. Access a Wider Network of Vetted Professionals

When you choose insurance covered online therapy, you’re not just saving money—you’re actually expanding your options for quality care. It might seem counterintuitive, but using insurance often gives you access to more therapists, not fewer.

Here’s why: many online therapy platforms work with thousands of licensed professionals specifically because they handle all the insurance paperwork and billing headaches. This administrative support attracts experienced therapists who might otherwise avoid insurance altogether due to the complexity.

The numbers are impressive. Major platforms maintain networks of tens of thousands of licensed providers across all 50 states, specializing in everything from anxiety and depression to more specialized approaches like trauma therapy or relationship counseling. These aren’t just any therapists—they’re vetted professionals who have been screened for licensing, experience, and clinical expertise.

What makes this even better? You can find a therapist who’s not only clinically qualified but also licensed to practice in Florida and experienced with your particular concerns. Need someone who specializes in anxiety disorders? Looking for a therapist who understands the unique pressures facing young professionals? The expanded network makes these matches possible.

The administrative burden is completely removed from your experience. While your therapist focuses entirely on providing excellent care, the platform handles insurance verification, claims processing, and billing. This means no paperwork hassles for you and no distractions for your therapist—just quality mental healthcare when you need it.

This combination of choice, expertise, and convenience is what makes insurance covered online therapy such a powerful option for getting the right care at the right price.

3. Seamless and Convenient Experience

Picture this: you’re having a particularly stressful day at work, and instead of waiting weeks for your next therapy appointment, you simply log into your secure platform during lunch and connect with your therapist. This is the reality of insurance covered online therapy – and it’s why 98% of users find it more convenient than traditional face-to-face sessions.

The convenience goes far beyond just location flexibility. When your insurance covers your online therapy, the entire experience becomes remarkably smooth. Gone are the days of wrestling with insurance paperwork, waiting for reimbursement checks, or wondering if you can afford your next session.

No paperwork headaches plague you because the online platform handles all the insurance claims and billing directly. You don’t need to fill out lengthy forms, mail documents, or follow up on payments. The therapy platform’s billing team takes care of everything behind the scenes.

Direct billing means you only pay your copay (often $0-$25) right at the time of service, just like picking up a prescription at the pharmacy. There’s no upfront payment followed by months of waiting for insurance reimbursement. Your costs are predictable and transparent from day one.

Most importantly, this streamlined process lets you focus entirely on healing. Without the stress of administrative tasks weighing on your mind, you can dedicate your full attention to what really matters – your therapy sessions and mental well-being. There’s something powerful about knowing that the logistics are handled, allowing you to be fully present for your own growth and recovery.

This seamless experience removes the common barriers that often prevent people from starting or continuing their mental health journey. When accessing care is this straightforward, you’re more likely to stick with treatment and see real, lasting results.

A 4-Step Guide to Verify Your Insurance Coverage

Verifying your insurance for online therapy might seem daunting, but it’s a straightforward process that can save you hundreds. This guide breaks it down into four simple steps.

Before you start, grab your insurance card. You’ll need your member ID, group number, and the customer service phone number on the back to understand your insurance covered online therapy benefits.

Step 1: Check the Platform’s Website

The quickest way to start is on the therapy platform’s website. Most have an “Insurance Checker” tool that gives you a snapshot of your coverage in minutes. You’ll enter your insurance provider—like Aetna, Cigna, Optum, or Florida Blue—and your member ID. These tools can often estimate your copay and tell you if you’ve met your deductible, giving you a preview of your costs. For a full list of accepted plans, check our Insurance Companies page.

Step 2: Call Your Insurance Provider Directly

For definitive answers, call the “Member Services” or “Behavioral Health Benefits” number on your insurance card. When you speak to a representative, ask these key questions:

- “Do I have mental health benefits for telehealth or online therapy?”

- “What is my copay for in-network outpatient mental health services?”

- “How much of my annual deductible have I met?”

- “Are there any limits on the number of sessions per year?”

- “Does my plan cover virtual Intensive Outpatient Programs (IOP) or Partial Hospitalization Programs (PHP)?”

Pro tip: Note the date, the representative’s name, and any reference number they provide. This can prevent billing issues later.

Step 3: Review Your Summary of Benefits

Review your Summary of Benefits and Coverage (SBC) document, which you can get from your HR department or your insurer’s online portal. Look for the section on mental health and substance use disorder benefits to see exactly what’s covered and what you’ll pay. Also, check if your employer offers an Employee Assistance Program (EAP), which often includes a set number of free therapy sessions. Thanks to mental health parity laws, your plan must treat mental health benefits similarly to medical benefits in terms of cost-sharing.

Step 4: Ask About Coverage in Your State

Be aware that insurance covered online therapy benefits can differ by state, but Florida has strong telehealth laws that ensure broad coverage for virtual mental health care. A critical rule is that your therapist must be licensed in Florida if you are physically located in the state during your sessions. At Thrive Mental Health, our licensed professionals are proud to serve clients across Florida, including major areas like Miami, Orlando, Tampa, and Jacksonville. When you call your insurer, ask if there are any Florida-specific benefits or requirements you should know about.

Frequently Asked Questions about Insurance Covered Online Therapy

How much does online therapy cost with insurance?

The good news? Insurance covered online therapy typically costs much less than you’d expect. Your out-of-pocket expense is usually just a copay, which can range from $0 to $50 per session, depending on your specific plan.

Once you meet your annual deductible, your insurance covers the majority of the session fee when you use in-network providers. Many people are pleasantly surprised to find their copay is only around $15 per session with major insurers like Aetna, Anthem, and Blue Cross Blue Shield. Some members with TRICARE and Medicare often have $0 copays entirely.

The key is using in-network providers. This is where platforms that partner directly with insurance companies really shine – they’ve already negotiated those lower rates for you. On average, clients save about 75% on their therapy sessions compared to paying out-of-pocket rates.

Can an online therapist prescribe medication?

This is where understanding the difference between therapists and psychiatrists becomes important. A therapist – like an LCSW (Licensed Clinical Social Worker) or LMFT (Licensed Marriage and Family Therapist) – cannot prescribe medication. They provide excellent talk therapy, coping strategies, and emotional support, but they’re not medical doctors.

However, many online platforms offer access to psychiatrists or psychiatric nurse practitioners who are medical providers licensed to diagnose conditions and prescribe medication. These professionals can handle both therapy sessions and medication management, giving you comprehensive care.

Insurance often covers these psychiatric services just like therapy sessions, so you’ll typically pay the same copay structure. One important note: online psychiatrists can prescribe most medications, though they typically do not prescribe controlled substances due to federal regulations.

What if my insurance doesn’t cover online therapy?

Don’t worry – you still have several options if your plan doesn’t cover a specific service or provider. First, you can pay out-of-pocket. Many online therapy platforms offer competitive self-pay rates, and some even provide financial aid or sliding scale fees based on your income.

You can also ask your provider for a “superbill” – this is a detailed receipt that you can submit to your insurance company for potential out-of-network reimbursement if your plan includes those benefits. It’s worth checking, as some people are eligible for partial reimbursement even when using out-of-network providers.

Another smart option is using funds from a Health Savings Account (HSA) or Flexible Spending Account (FSA) for therapy expenses. Mental health services are often considered qualified medical expenses, so you can use these pre-tax dollars to pay for your care.

At Thrive Mental Health, we understand that navigating insurance can feel overwhelming. Our team, which serves clients throughout Florida, can help you understand your benefits and explore all available options for our virtual and hybrid IOP/PHP programs.

Take the Next Step Toward Healing

You’ve learned how insurance covered online therapy makes professional support affordable and accessible. The financial and logistical barriers that once stood in the way of mental wellness have been removed, putting quality care within your reach.

You already pay for your insurance benefits; now is the time to use them for something that can genuinely improve your life. The hardest part is starting, but you don’t have to do it alone.

At Thrive Mental Health, we make it easy. We offer flexible, evidence-based virtual and hybrid programs designed for busy adults in Florida, and we work directly with your insurance.

Ready for support? Thrive offers virtual and hybrid IOP/PHP with evening options. Verify your insurance in 2 minutes (no obligation) → Start benefits check or call 561-203-6085.

If you’re in crisis, call or text 988.